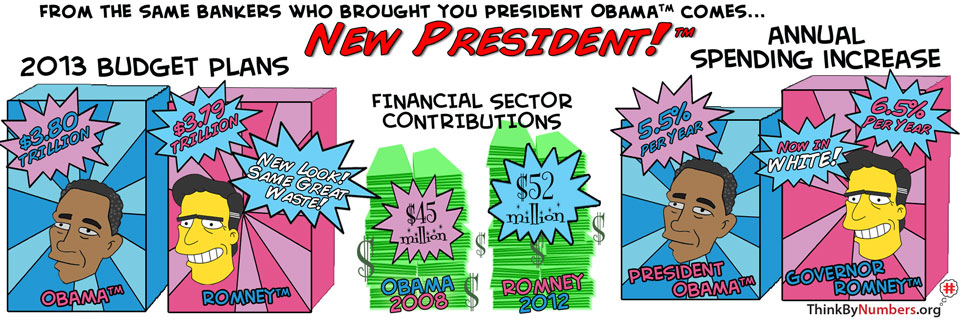

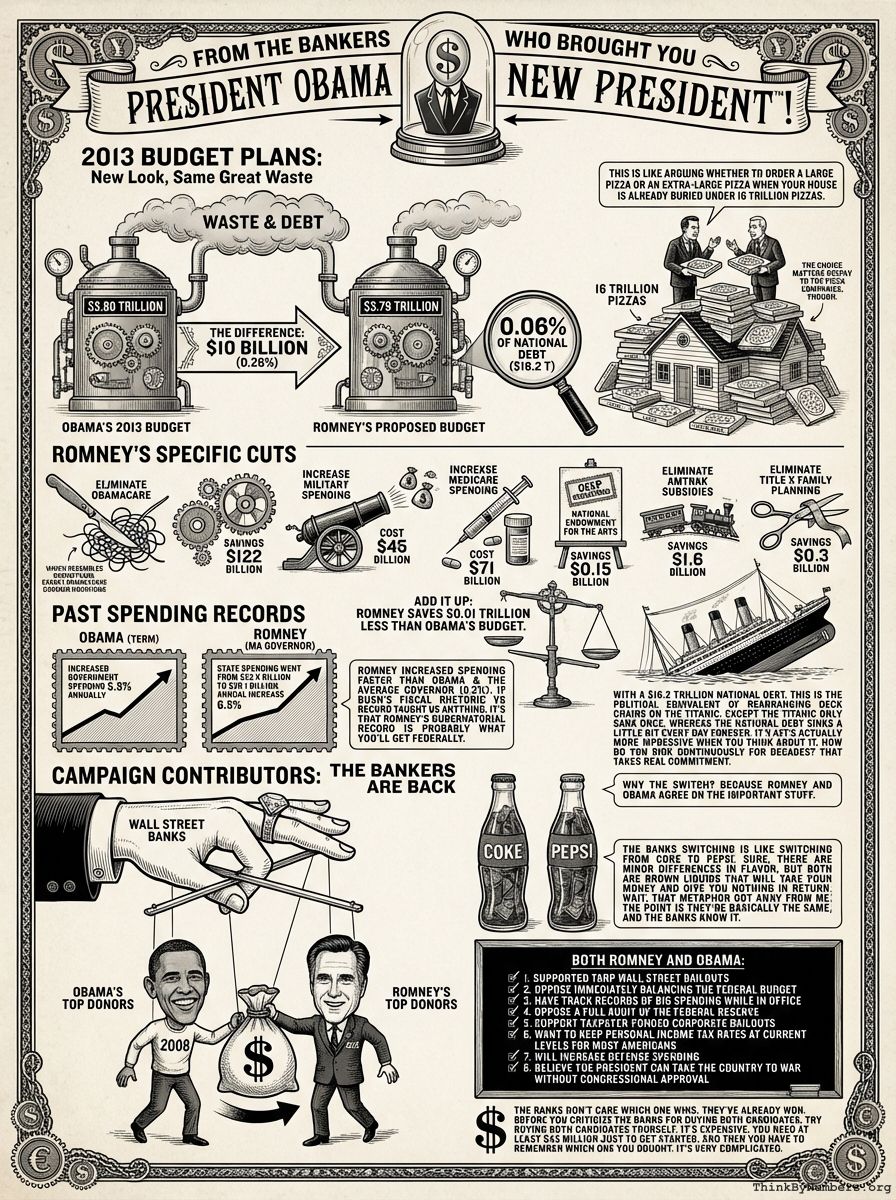

2013 Budget Plans: New Look, Same Great Waste

Obama's 2013 budget: $3.80 trillion.

Romney's proposed budget: $3.79 trillion.

The difference: $10 billion, or 0.26%.

For context, the national debt is $16.2 trillion. The difference between these budgets would pay down 0.06% of the debt.

This is like arguing whether to order a large pizza or an extra-large pizza when your house is already buried under 16 trillion pizzas. The choice matters deeply to the pizza companies, though.

Romney's Specific Cuts

- Eliminate Obamacare (which resembles Romneycare, except Romneycare covered abortions): Savings $122 billion

- Increase Military Spending: Cost $45 billion

- Increase Medicare Spending: Cost $71 billion

- "Deep Reductions" in National Endowment for the Arts: Savings $0.15 billion

- Eliminate Amtrak Subsidies: Savings $1.6 billion

- Eliminate Title X Family Planning: Savings $0.3 billion

Add it up: Romney saves $0.01 trillion less than Obama's budget.

With a $16.2 trillion national debt, this is the political equivalent of rearranging deck chairs on the Titanic.

Except the Titanic only sank once, whereas the national debt sinks a little bit every day forever. It's actually more impressive when you think about it. How do you sink continuously for decades? That takes real commitment.

Past Spending Records

Obama increased government spending 5.5% annually during his term.

Under Romney as Massachusetts Governor, state spending went from $22.3 billion to $28.1 billion, an annual increase of 6.5%.

Romney increased spending faster than Obama. Romney increased spending faster than the average governor (6.2%).

If George W. Bush's fiscal rhetoric versus fiscal record taught us anything, it's that Romney's gubernatorial record is probably what you'll get federally.

Campaign Contributors: The Bankers Are Back

The Wall Street banks that received TARP bailouts and were Obama's top donors in 2008 are now Romney's top donors in 2012.

Why the switch? Because Romney and Obama agree on the important stuff.

The banks switching from Obama to Romney is like switching from Coke to Pepsi. Sure, there are minor differences in flavor, but both are brown liquids that will take your money and give you nothing in return. Wait, that metaphor got away from me. The point is they're basically the same, and the banks know it.

Both Romney and Obama:

- Supported TARP Wall Street bailouts

- Oppose immediately balancing the federal budget

- Have track records of big spending while in office

- Oppose a full audit of the Federal Reserve

- Support taxpayer-funded corporate bailouts

- Want to keep personal income tax rates at current levels for most Americans

- Will increase defense spending

- Believe the President can take the country to war without Congressional approval

The banks don't care which one wins. They've already won.

Before you criticize the banks for buying both candidates, try buying both candidates yourself. It's expensive. You need at least $43 million just to get started, and then you have to remember which one you bought. It's very complicated.

Comments