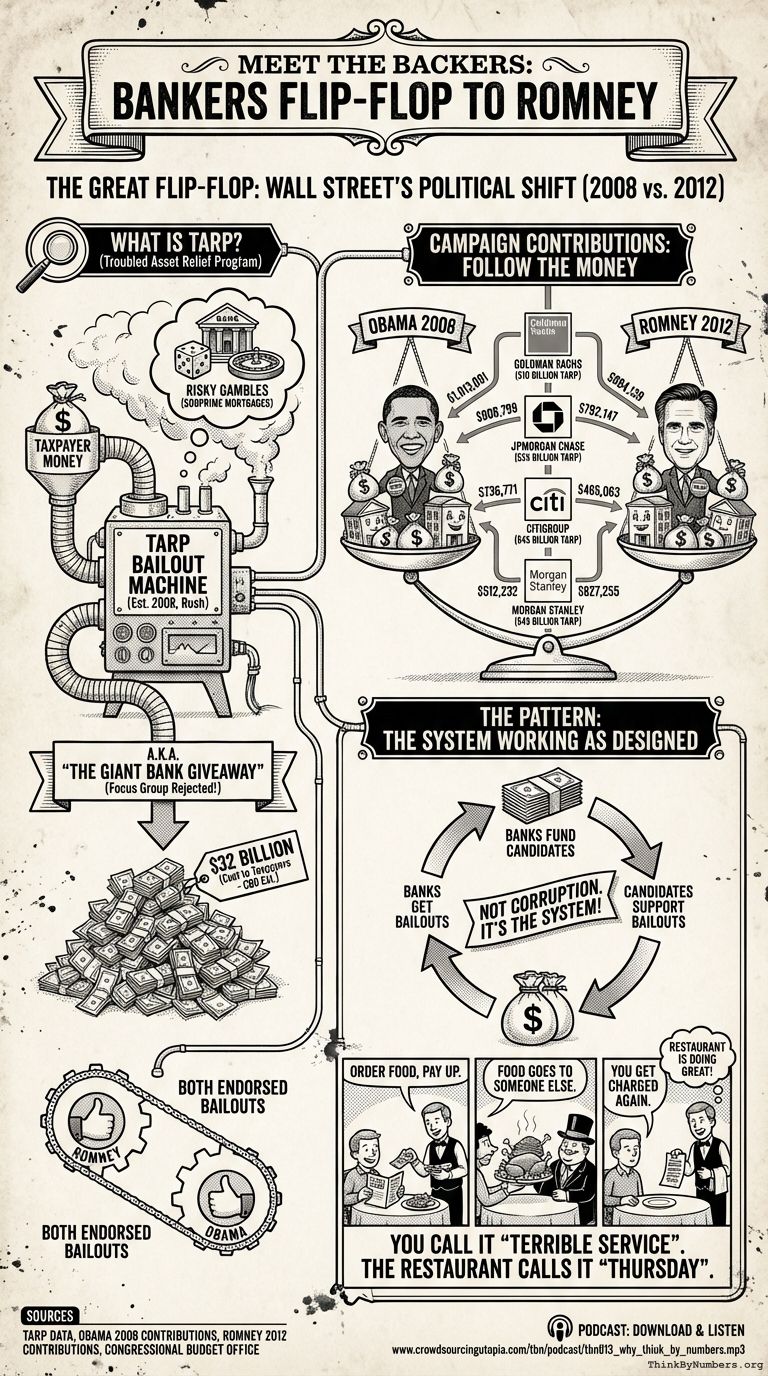

The Wall Street banks that funded Obama in 2008 switched to Romney in 2012.

What Is TARP?

TARP is the Wall Street bailout program. President Bush started it in 2008.

TARP stands for Troubled Asset Relief Program, which is a very serious name for "we gave all your money to banks who gambled it away." The government tried calling it "The Giant Bank Giveaway" but focus groups said that was too honest.

Banks knowingly provided risky subprime mortgages that borrowers couldn't pay back. When this became a problem, the government bought into the banks using your money.

The government ultimately spent $32 billion on TARP according to Congressional Budget Office estimates.

Romney endorsed TARP multiple times. Obama continued it.

Campaign Contributions: Follow The Money

The banks that needed bailouts still had money for campaign contributions.

| Company | TARP Bailout | Obama 2008 | Romney 2012 |

| Goldman Sachs | $10 billion | $1,013,091 | $994,139 |

| JPMorgan Chase | $25 billion | $808,799 | $792,147 |

| Citigroup | $45 billion | $736,771 | $465,063 |

| Morgan Stanley | $45 billion | $512,232 | $827,255 |

Goldman Sachs needed a $10 billion bailout. They gave Obama over $1 million in 2008. They gave Romney about $1 million in 2012.

JPMorgan Chase needed $25 billion. They gave both candidates about $800,000 each.

Citigroup needed $45 billion. They gave Obama $736,771 and Romney $465,063.

Morgan Stanley needed $45 billion. They gave Obama $512,232 and Romney $827,255.

The Pattern

The same banks fund both candidates. The candidates both support bailouts. The banks get bailouts.

This is not corruption. This is the system working as designed. The design just isn't what they teach in civics class.

It's like a restaurant where you order food, the waiter takes your money, brings food to someone else, and then charges you again. You might call this "terrible service," but the restaurant calls it "Thursday." The restaurant is doing great, by the way.

Sources: TARP data, Obama 2008 contributions, Romney 2012 contributions

Podcast: Play in new window | Download

Comments