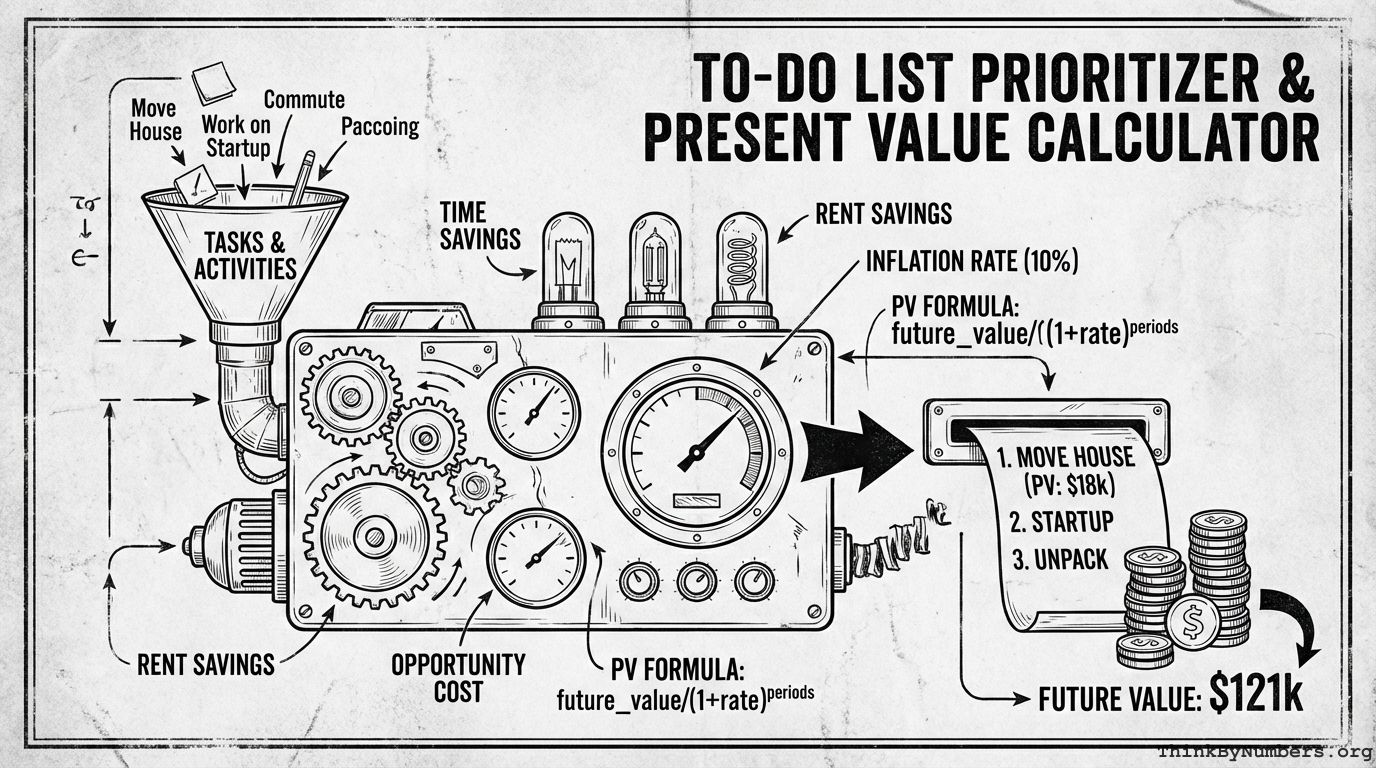

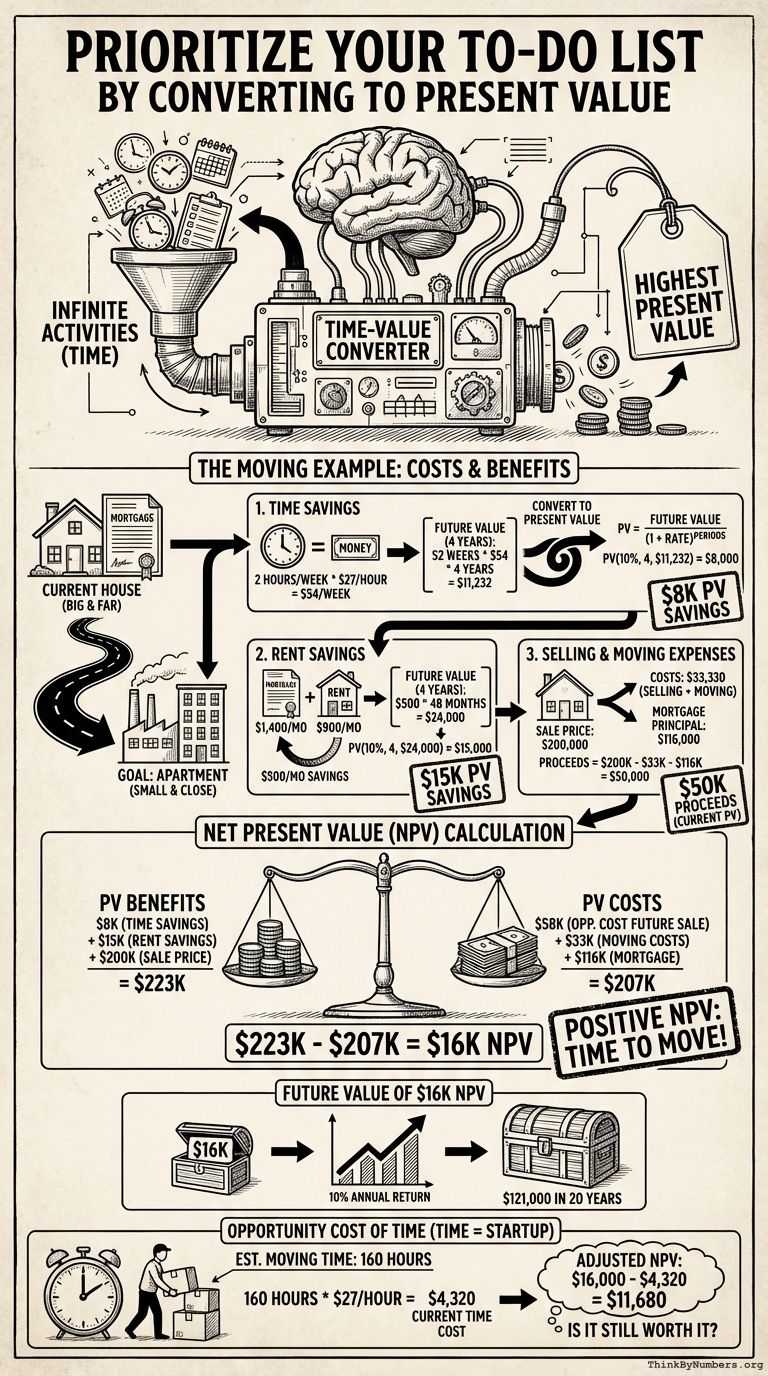

There are infinite ways to spend your most valuable resource: time. How do you decide the most cost-effective way to spend it? Convert the returns of each activity to its present value and pick the activity with the highest present value.

I live in a house that's bigger than I need and farther from my job than I'd like. I'd like to sell it and get a smaller apartment closer to work.

Costs and Benefits of Moving

1. Time Savings

Moving takes time. To do apples-to-apples comparisons, convert this time to monetary value. According to the Bureau of Labor Statistics, the average American worker makes $27/hour.

Moving closer to my job saves me 2 hours per week (equivalent to $54 in weekly earnings). I assume I'll work there for 4 more years. This gives us total savings of $11,232 (52 weeks × $54/week × 4 years).

However, due to inflation and interest-earning potential, a dollar today is worth more than a dollar tomorrow. To achieve apples-to-apples comparison, convert these savings to equivalent Present Value.

Calculate the equivalent present value using Google Sheets:

Present Value = future_value/(1 + rate)^number_of_periods

or in Google Sheets:

PV(rate, number_of_periods, future_value)

rate– The rate you could get by investing this money. 10% is the average annual return for the stock market.number_of_periods– We're using annual return and I'll save this drive for 4 years. Number of periods is 4.future_value– We'll save $11k (52 weeks × $54/week × 4 years).

The result is a Present Value of $8k for the time savings from not driving so much.

2. Rent Savings

Say my monthly mortgage payment is $1,400/month. I can get a smaller apartment for $900/month. I'll save $500 per month on rent. After 4 years, that saves me $24k. Plugging those numbers into our PV formula gives us $15k.

2. Selling & Moving Expenses

Moving comes with cost. Assuming a sale price of $200,000, the typical costs of selling a house and moving are $33,330.

Also, assume you have $116k remaining on the principal of your mortgage. That brings our total proceeds down to $50k.

So far, our total PV from moving is $58k ($8 plus $50k).

3. Opportunity Cost of Future Sale

We need to consider the opportunity cost to sell our house in 20 years once the mortgage is paid off. The U.S. House Price Index shows prices have risen at 3.4% per year on average since 1991.

To calculate expected future value based on your growth rate, add one to the rate and raise this to a power equal to the number of years you're looking at.

future_value = (1 + annual_growth_rate) ^ years * current_value

or

(1 + 0.0034) ^ 20 years * $200k = $390k Future Value

In 20 years, our home should be worth $390k. Let's convert that back to Present Value for apples-to-apples comparison.

Present Value = $390k/(1 + 0.1)^(20 years) = $58k

Net Present Value

Net Present Value is what helps us make our final decision. It is the present value of benefits minus the present value of costs.

In our case, the Net Present Value is:

$7k + $18k - $58k - $33k + $200k - $116k = $18k

Since $18k is positive, it's time to move.

Future Value

Let's calculate how much better off we'll be in 20 years if we sell. We can invest this $18k in an index fund getting us 10% return a year. In 20 years, this $18k will be worth $121k.

Opportunity Cost

However, let's say I have a startup business I could work on in the time I spend moving. Let's calculate how much time moving takes.

It takes about 40 hours to pack everything and another 40 hours to unpack and move. We often underestimate, so let's double that to 160 hours. The median hourly rate is $27/hour. That's a current time cost of $4,320, bringing our total Present Value down to $14k.

Comments