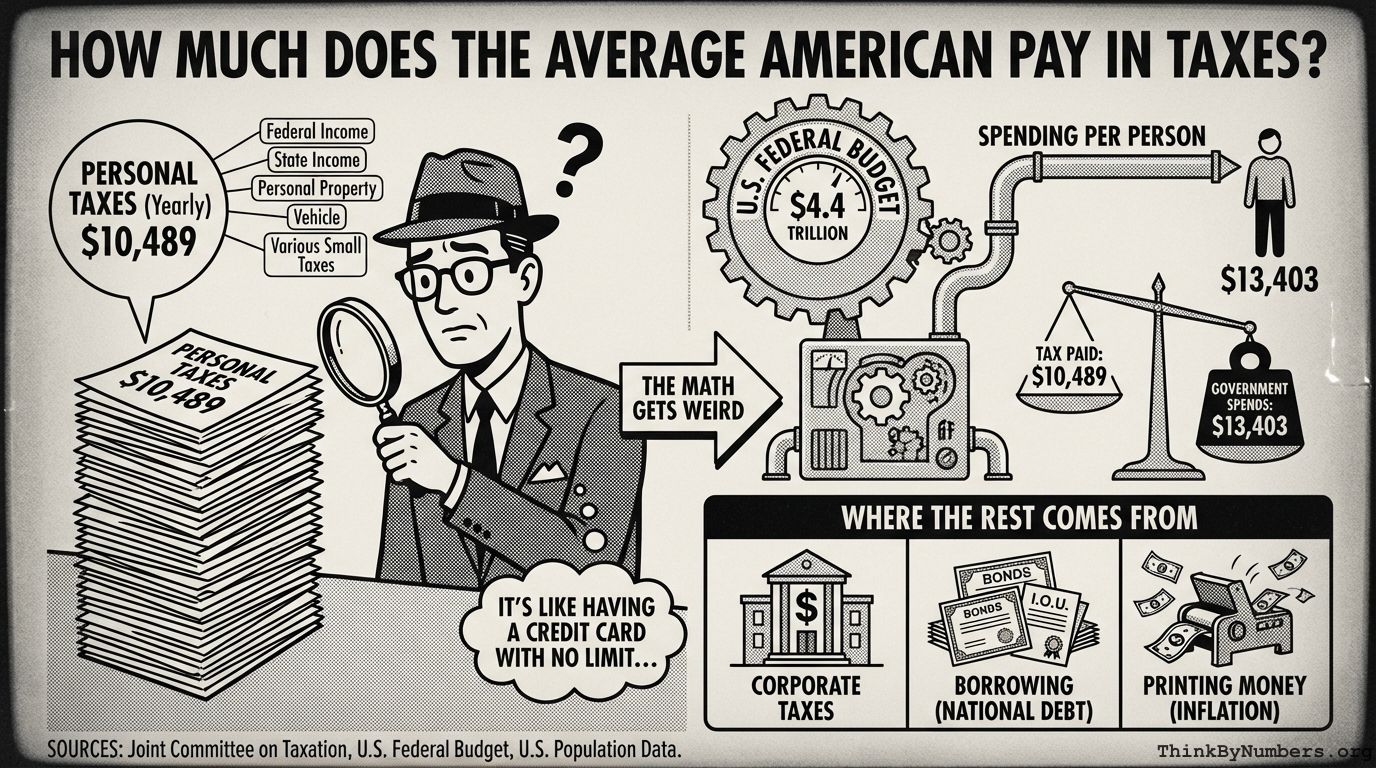

The average American household pays $10,489 in "personal taxes" each year. This represents 14% of average household income.

That covers:

- Federal income taxes

- State income taxes

- Personal property taxes

- Vehicle taxes

- Various small taxes you forgot existed

The Math Gets Weird

The entire U.S. Federal Budget is $4.4 trillion.

The U.S. population is 328,316,410 people.

If you divide the federal budget by the population, the government spends $13,403 per person per year.

But the average household only pays $10,489 in total taxes.

Someone is covering the difference. Either that, or the government invented a money-printing machine and forgot to mention it. (Spoiler: They mentioned it. It's called the Federal Reserve, and yes, they literally print money.)

What This Means

If you're wondering where all that federal spending money comes from when individual tax payments don't add up to the total budget, you're asking the right questions.

The government covers the gap through:

- Corporate taxes

- Borrowing (national debt)

- Printing money (inflation)

- Fees and other revenue sources

You're not imagining it. The government spends more than it collects from you personally. The rest comes from somewhere, and that somewhere usually involves either borrowing from the future or making everyone's existing money worth slightly less.

It's like having a credit card with no limit and paying the minimum by devaluing everyone else's currency. You have third grade, so the confusion about why this continues is understandable.

Related

See how much the government spends per person

Comments