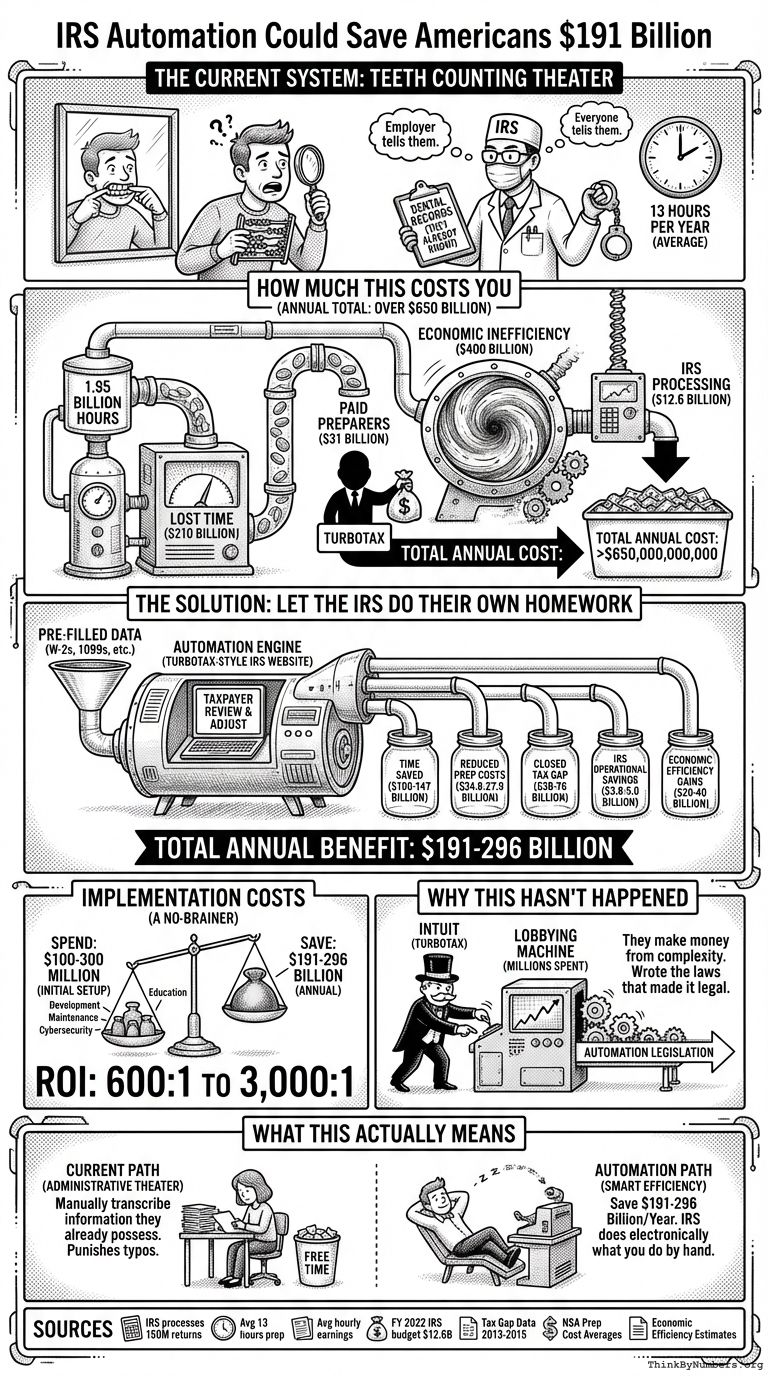

The IRS already knows how much you owe. Your employer tells them. Your bank tells them. Everyone tells them everything.

Then they make you spend 13 hours calculating what they already know, threatening you with prison if you get it wrong.

It's like making you count your own teeth before a dentist appointment, except the dentist already has your dental records and will arrest you if you miscount.

How Much This Costs You

Every year, Americans spend:

- 1.95 billion hours preparing tax returns (13 hours per taxpayer average)

- $210 billion in lost time (based on average hourly earnings)

- $31 billion paying tax preparers to do what could be automatic

- $400 billion in economic inefficiency from tax-induced behavioral changes

Total annual cost: Over $650 billion

The IRS processing all this paperwork costs another $12.6 billion per year.

You're paying $650 billion annually to manually calculate information the government already has. That's not a typo. $650,000,000,000.

The Solution: Let The IRS Do Their Own Homework

Here's how you fix this:

1. Build a TurboTax-style IRS website

- Pre-fill forms with data the IRS already has

- Let taxpayers review, adjust, and submit

- Provide simple explanations in human language

2. Expected savings:

- Time saved: 975 million to 1.37 billion hours annually

- Money saved: $105-147 billion (time value)

- Reduced tax prep costs: $24.8-27.9 billion (80-90% reduction)

- Closed tax gap: $38-76 billion (from improved accuracy)

- IRS operational savings: $3.8-5.0 billion (30-40% reduction)

- Economic efficiency gains: $20-40 billion

Total annual benefit: $191-296 billion

3. Implementation costs:

- Initial development: $50-100 million

- Annual maintenance: $10-20 million

- Cybersecurity: $50-100 million initial, $10-20 million annually

- Public education: $100-200 million initial, $20-50 million annually

Total annual operating cost after setup: About $40-90 million.

You'd spend roughly $100-300 million to save $191-296 billion per year. That's a 600:1 to 3,000:1 return on investment. The math requires third-grade arithmetic.

Why This Hasn't Happened

TurboTax's parent company, Intuit, has spent millions lobbying against this. They make money from the current system being complicated.

It's like hiring someone to mess up your house so you'll pay them to clean it. Except it's legal, and they wrote the laws that made it legal, and everyone pretends this is normal.

How To Actually Do This

- Pass legislation requiring IRS to build free filing software

- Mandate pre-filling with all available data

- Set a 3-5 year implementation timeline

- Fund proper cybersecurity from the start

- Run parallel systems during transition

The technology exists. TurboTax already does this, except they charge you for it and lobby to keep alternatives illegal.

The Tax Gap Problem

The "tax gap" - the difference between taxes owed and taxes collected - is $380 billion annually (2013-2015 average).

Automation could close 10-20% of this gap through improved accuracy. That's $38-76 billion in additional tax revenue without raising anyone's tax rates.

You could collect more taxes by making the system simpler. The current complexity isn't catching tax cheats. It's just annoying honest people while sophisticated tax avoiders hire expensive accountants.

The Weird Efficiency Thing

There's also something economists call "tax-induced economic distortions" - basically, people making stupid financial decisions solely because of tax implications rather than actual economic value.

Current cost: $400 billion annually

Potential reduction with simpler system: $20-40 billion

You're watching people spend money inefficiently because tax law is so complex they can't figure out the best option. It's like watching someone buy 40 umbrellas because the tax code made it seem like a good idea.

What This Actually Means

The U.S. could save $191-296 billion per year by letting the IRS do electronically what it currently makes you do by hand.

Instead, you spend 13 hours per year calculating numbers the government already knows, pay someone else to double-check your math, and hope the IRS agrees with both of you.

The IRS already has your W-2s, 1099s, mortgage interest statements, and investment records. Banks and employers are required to send them copies. They're making you manually transcribe information they already possess, then punishing you if you make a typo.

It's administrative theater. Security theater prevents terrorism. This prevents nothing except free time.

Sources

- IRS processes 150 million individual tax returns annually

- Average tax preparation time: 13 hours per taxpayer

- Average hourly earnings calculation for time cost

- FY 2022 IRS budget: $12.6 billion

- Tax gap data: IRS Tax Gap Estimates 2013-2015

- Tax prep cost averages from National Society of Accountants

- Economic efficiency estimates from tax policy research

Comments