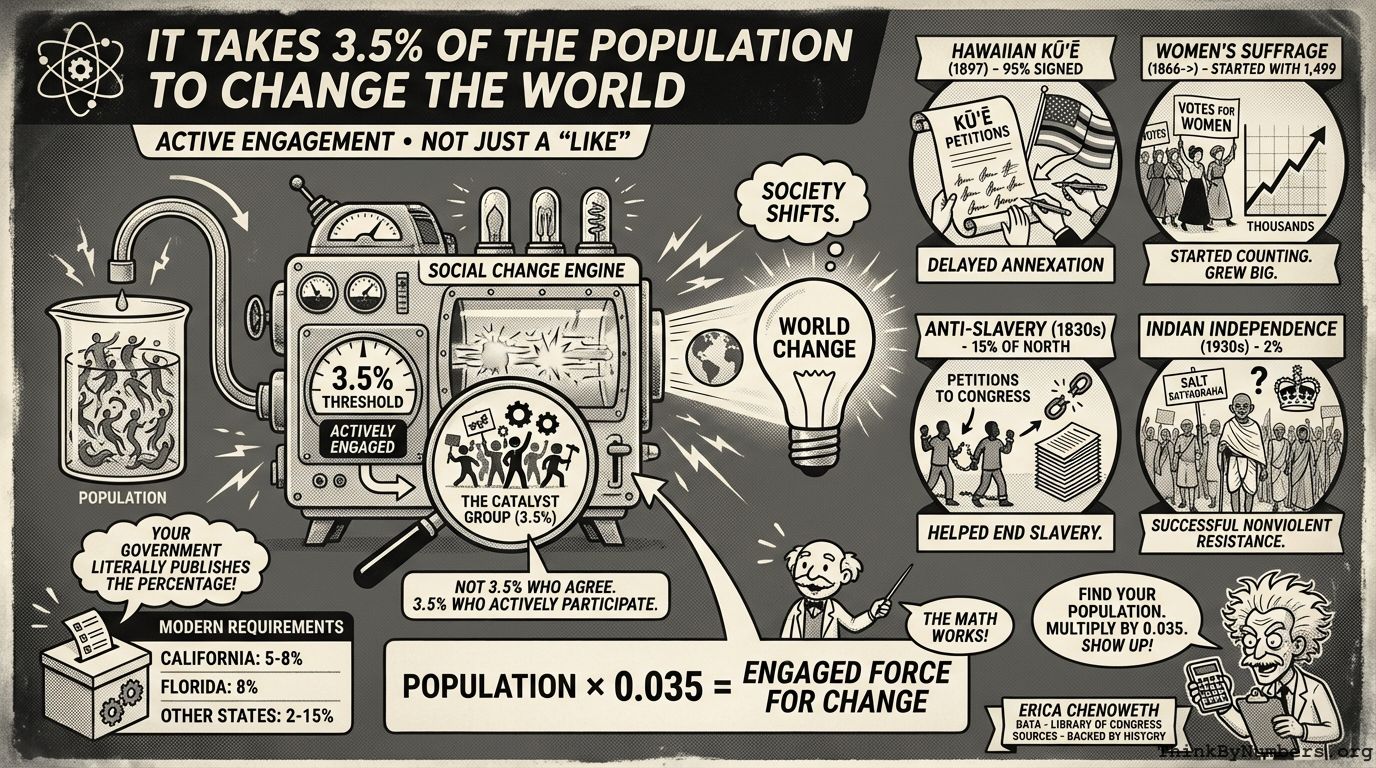

Harvard study shows 3.5% active participation changes society. Not clicking "like." Actual showing up. Your government publishes the percentage needed.

Recent Posts

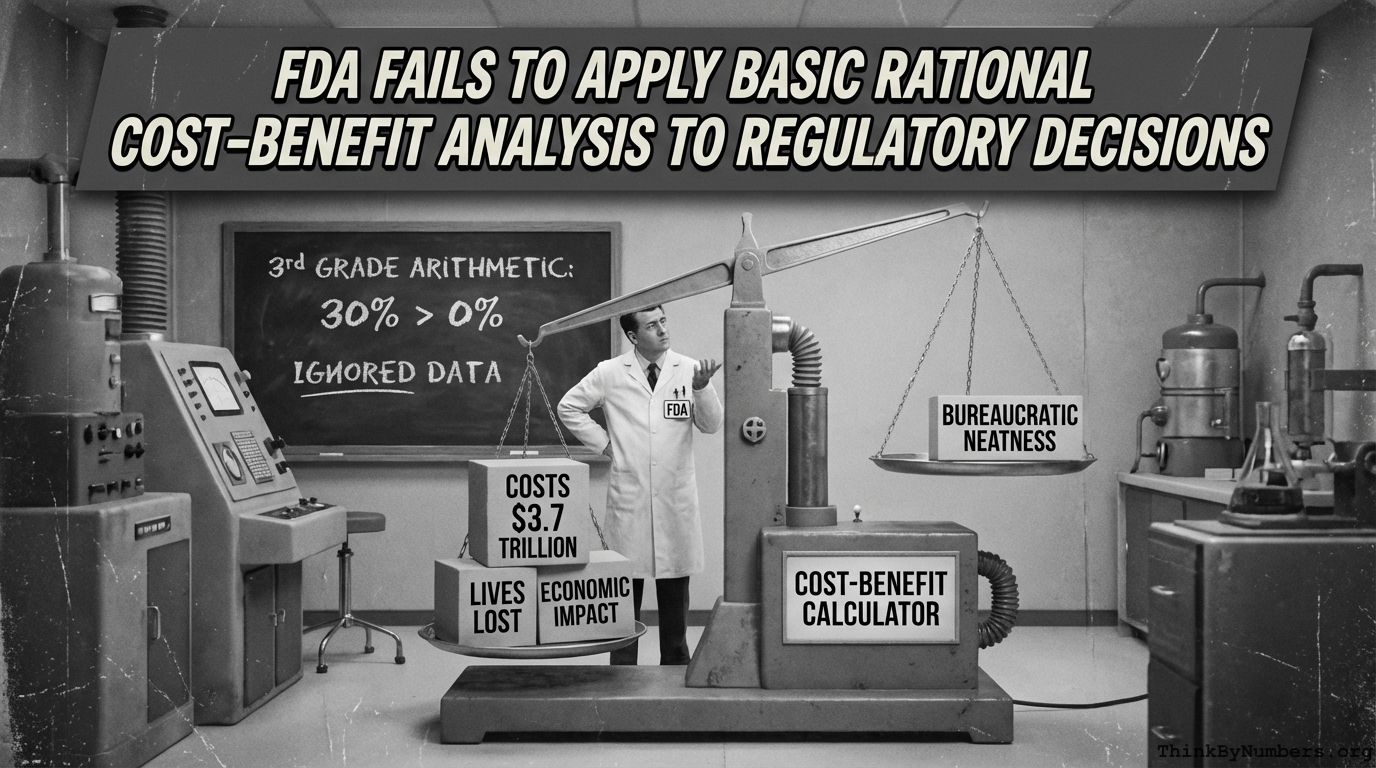

FDA banned monoclonal antibodies despite 30% efficacy. They ignored $3.7T Long COVID cost, risked $600M in preventable hospitalizations.

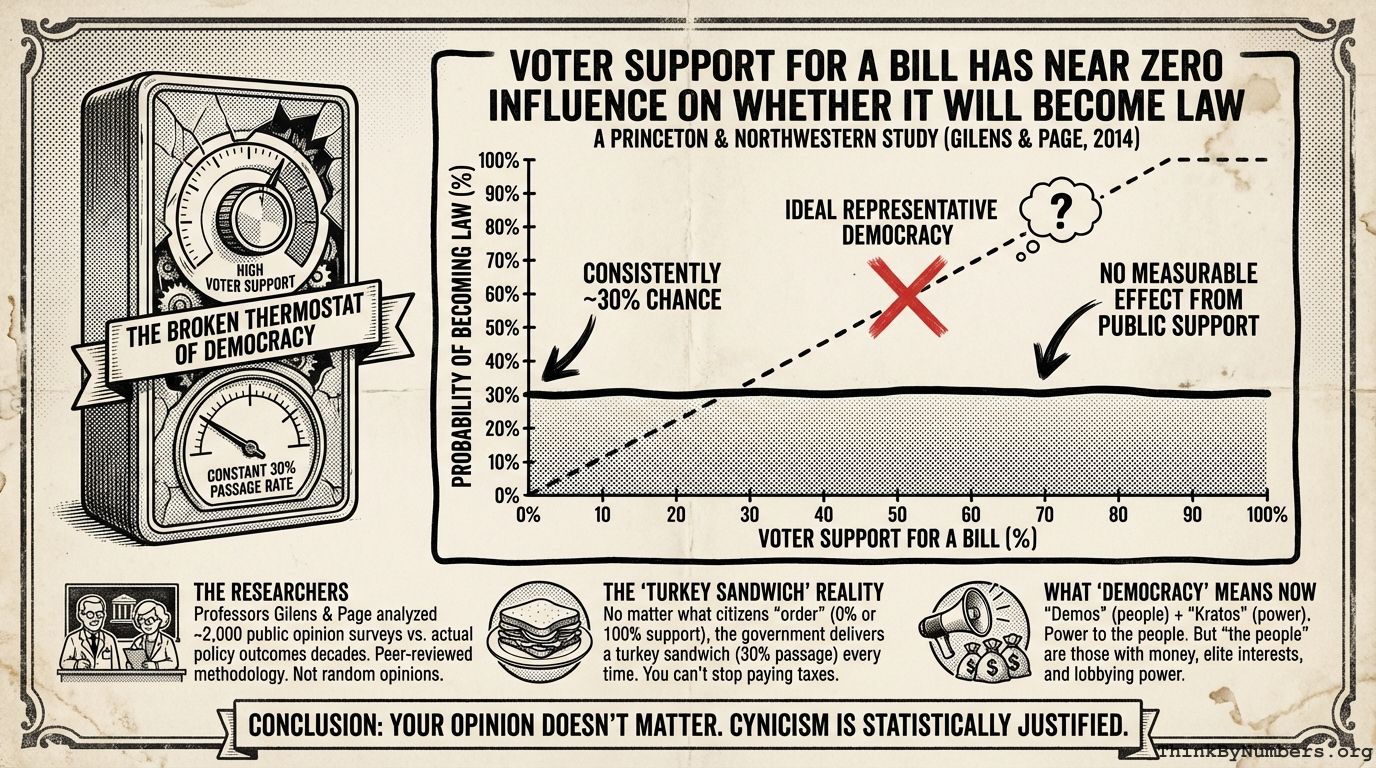

Princeton study shows 90% of Americans have zero impact on legislation. 0% or 100% support both equal 30% passage chance. Democracy is flat line.

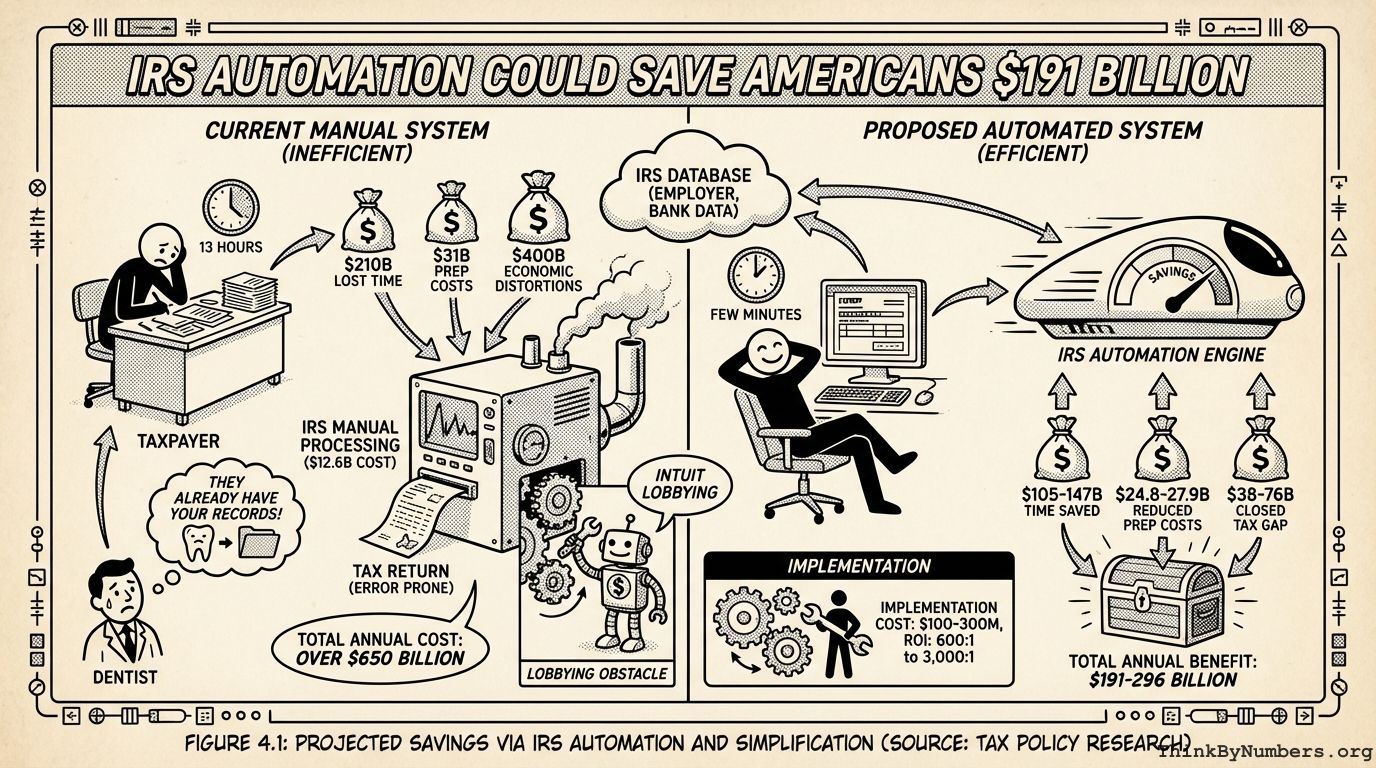

IRS already has your data; automating returns could save $191 billion. Instead, they make you spend 13 hours transcribing what they know and threaten prison if you miscalculate.

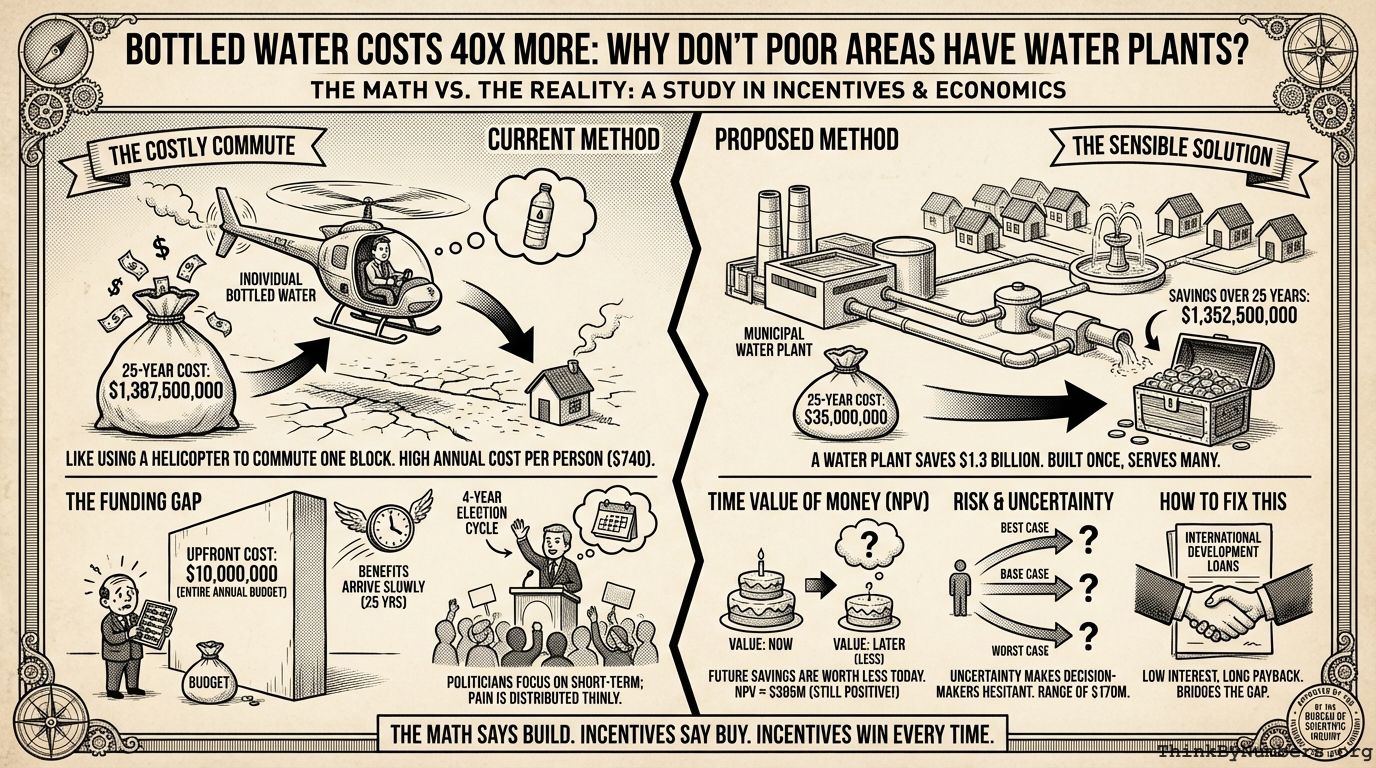

Roatan residents spend $740/year on bottled water. Building a water plant costs 40x less over 25 years. The math is third-grade arithmetic. Like using a helicopter to commute one block.

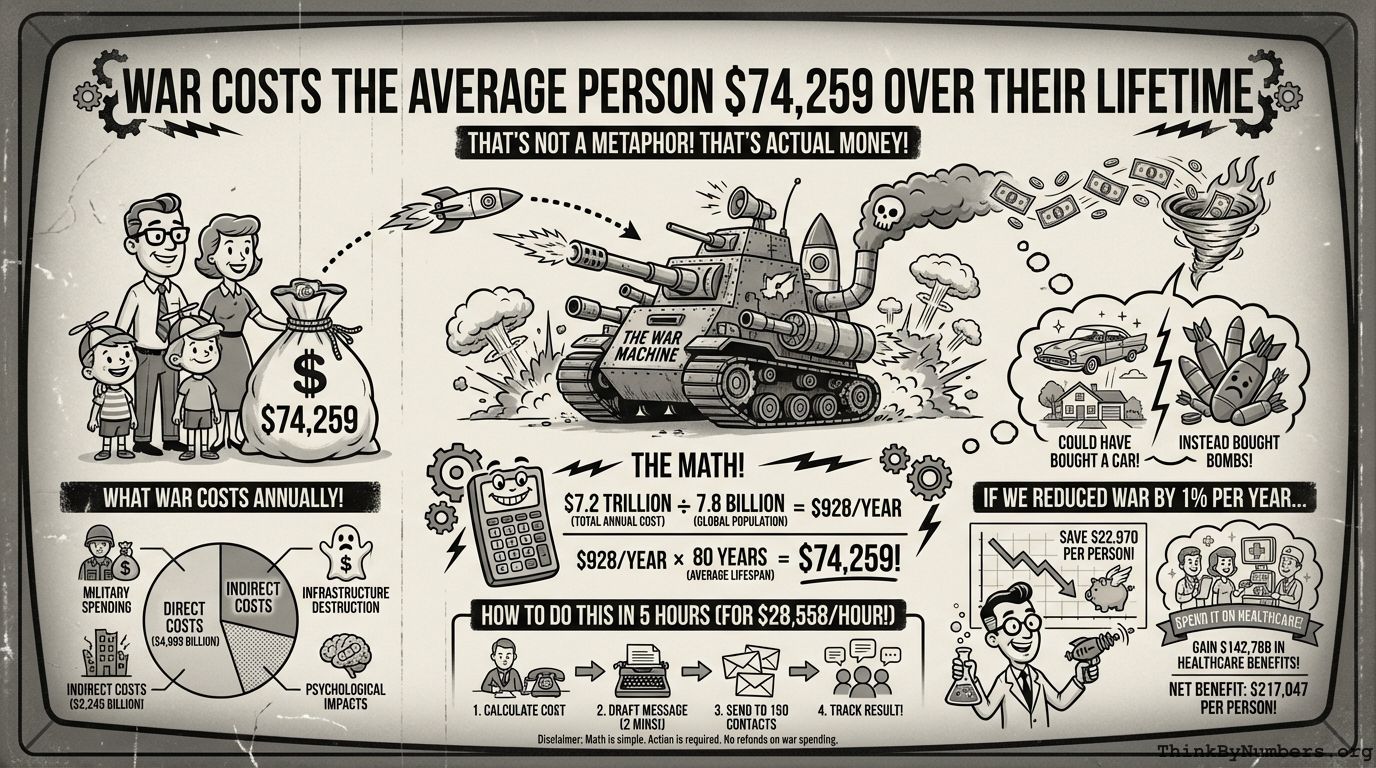

War costs you $74,259 in lifetime taxes. That's a car's worth of money spent on bombs instead of things that don't explode people.

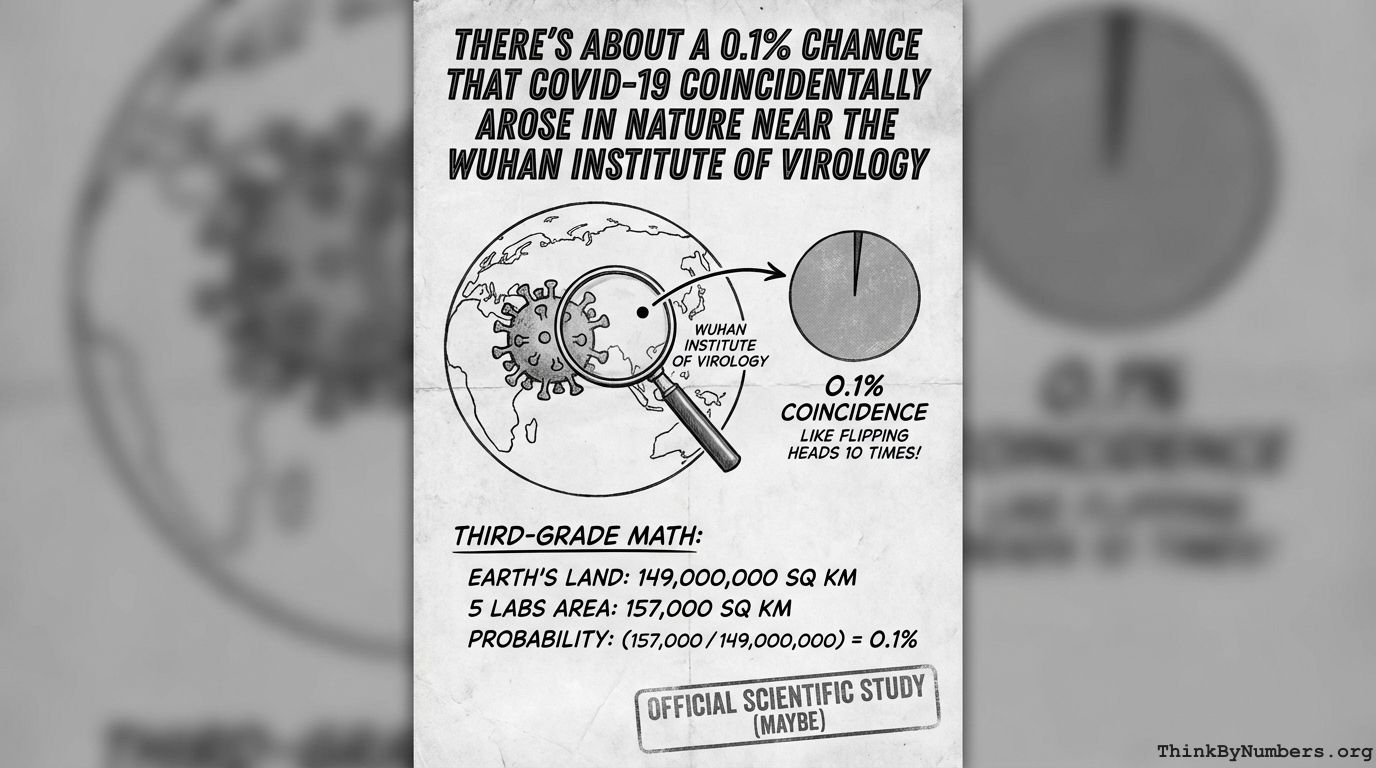

0.1% chance novel coronavirus appeared near the only 5 labs studying this exact virus. Basic math meets uncomfortable facts.

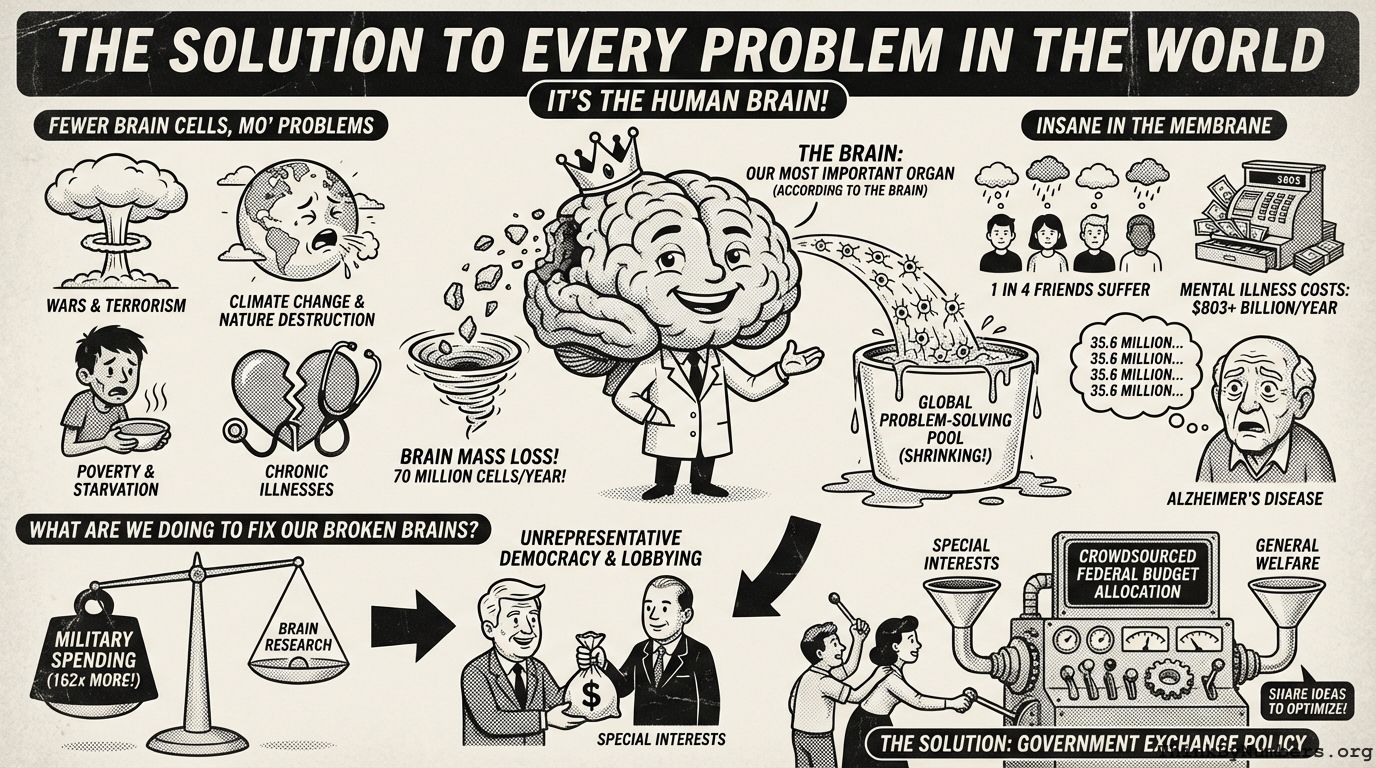

1 in 20 million terrorism death chance. 1 in 10 Alzheimer's chance. We spend 162x more on military than brain research. Math is wrong.

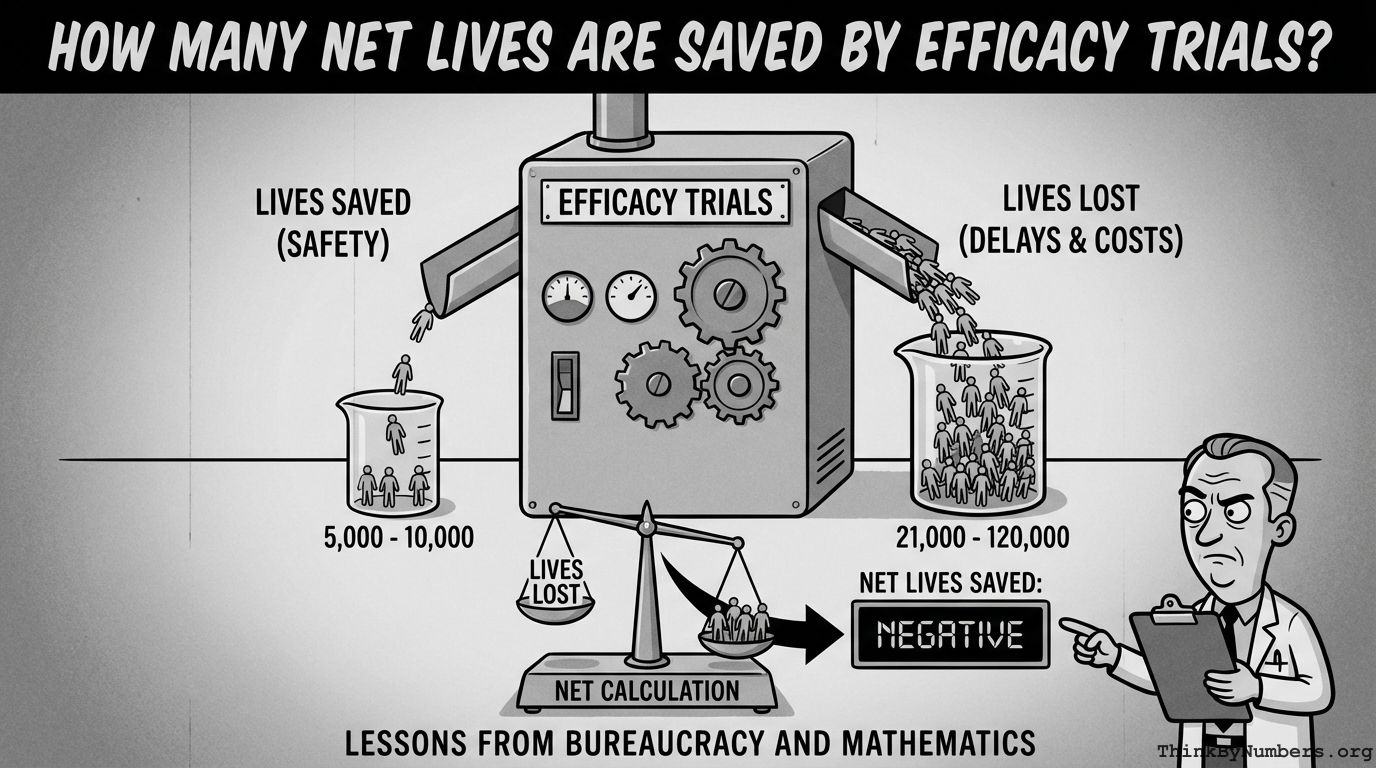

FDA regulations killed medical progress by 70% in 1962. Lifespan growth immediately cut in half. Drug development now costs 13 times more.

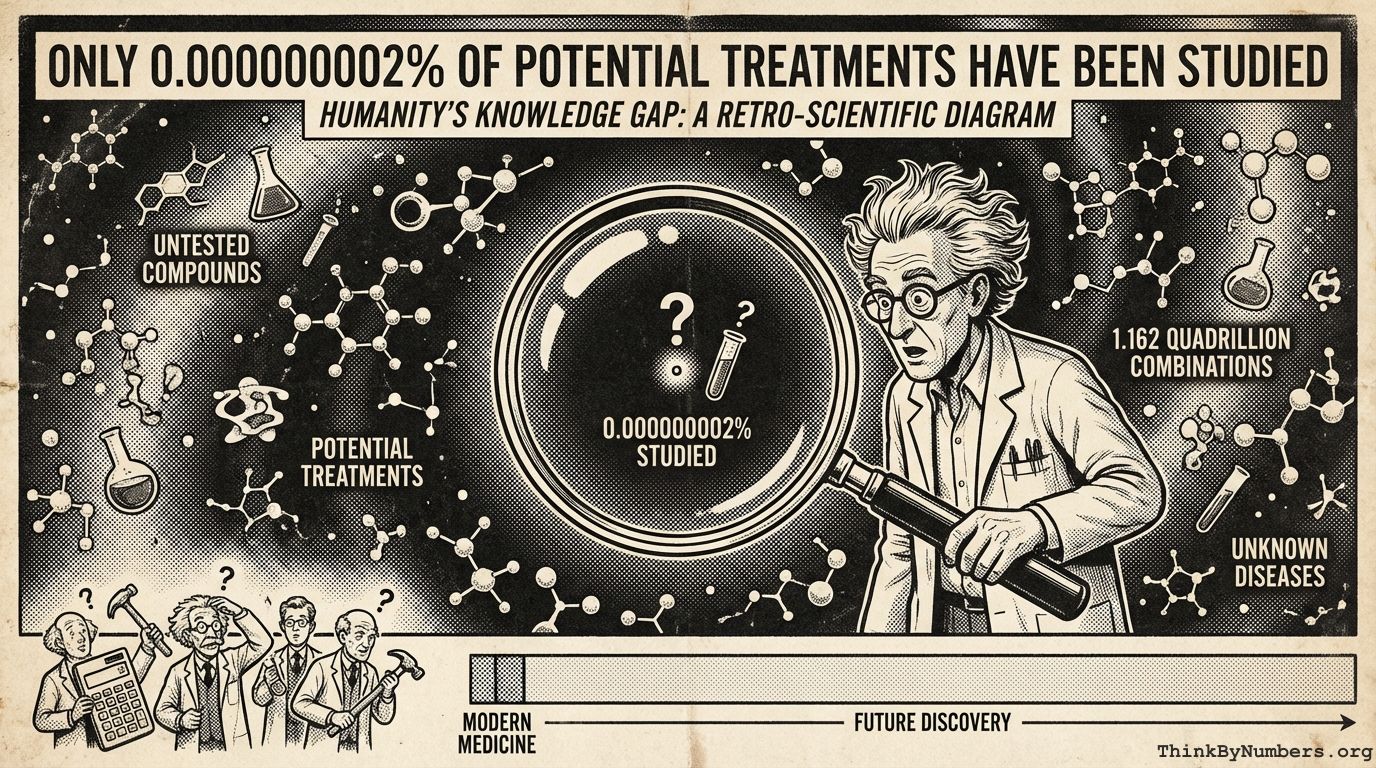

Only 21,000 of 1.162 quadrillion possible drug combinations tested. Would take 3.2 billion years at current pace. Earth is 4.5 billion years old.