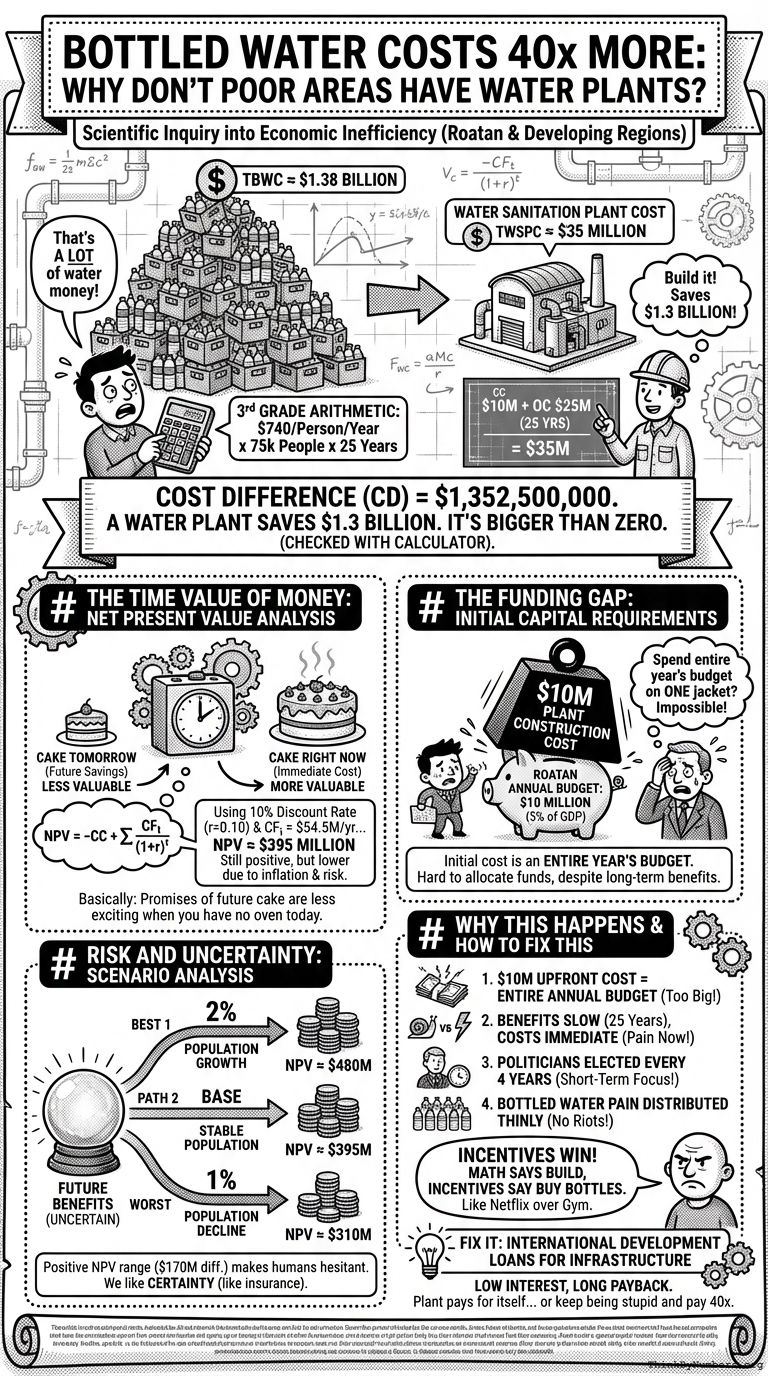

On Roatan (and many developing regions), people spend 40 times more buying bottled water than it would cost to just build a water plant. Why don't they build the plant? The math requires third-grade arithmetic, so the confusion is notable. It's like watching someone use a helicopter to commute one block because they haven't discovered walking yet.

The Math

- Bottled Water Cost (BWC):

- Annual cost per person: $740 (conservative estimate for Roatan)

- Population (P): 75,000 (approximate for Roatan)

- Time horizon (T): 25 years (typical lifespan of a water plant) Total Bottled Water Cost (TBWC) = BWC * P * T TBWC = $740 * 75,000 * 25 = $1,387,500,000

- Water Sanitation Plant Cost (WSPC):

- Construction cost (CC): $10,000,000

- Annual operating cost (OC): $1,000,000 Total Water Sanitation Plant Cost (TWSPC) = CC + (OC * T) TWSPC = $10,000,000 + ($1,000,000 * 25) = $35,000,000

The cost difference (CD) over 25 years: CD = TBWC – TWSPC = $1,387,500,000 – $35,000,000 = $1,352,500,000

A water plant would save $1.3 billion over 25 years. $1.3 billion is bigger than $0. I checked. I used a calculator and everything. So why not build it?

The Time Value of Money: Net Present Value Analysis

One key factor is the time value of money. Future savings are worth less than immediate costs. It's like how a promise of cake tomorrow is worth less than cake right now, especially if you're not sure the promise-maker even has an oven.

Let's use Net Present Value (NPV) analysis with a discount rate (r) of 10% (common in developing regions due to high risk and inflation):

NPV = -CC + Σ(CFt / (1+r)^t)

Where: CC = Construction cost CFt = Cash flow in year t (savings from not buying bottled water minus operating costs) r = Discount rate t = Year (1 to 25)

CFt = (BWC * P) – OC = ($740 * 75,000) – $1,000,000 = $54,500,000

Using this formula (which can be calculated precisely using spreadsheet software), we find:

NPV ≈ $395,000,000

While still positive, this number is significantly lower than the simple cost difference calculated earlier. This NPV represents the project's value in today's money, accounting for the time value of money. Economics is basically just figuring out how to make people care about the future when they're worried about right now.

The Funding Gap: Initial Capital Requirements

Despite the positive NPV, the initial capital requirement presents a significant barrier. Let's compare it to the annual government budget:

Assuming Roatan's government budget is 5% of its GDP:

- Roatan's GDP (estimated): $200 million

- Annual government budget: $10 million

The water plant's construction cost ($10 million) represents an entire year's budget. This highlights the difficulty in allocating funds to a single project, despite its long-term benefits. It's like asking someone to spend their entire year's salary on a really good jacket that will last forever. Mathematically sound, emotionally impossible.

Risk and Uncertainty: Scenario Analysis

Future benefits are also uncertain. Let's consider three scenarios:

- Best case: 2% annual population growth

- Base case: Stable population

- Worst case: 1% annual population decline

We can calculate the NPV for each scenario:

- Best case NPV ≈ $480 million

- Base case NPV ≈ $395 million (as calculated earlier)

- Worst case NPV ≈ $310 million

While all scenarios show a positive NPV, the uncertainty represented by this range ($170 million difference between best and worst cases) can make decision-makers hesitant. Humans don't like uncertainty. We like certainty. That's why we invented insurance, which is basically paying money to make uncertainty go away.

Why This Happens

- The $10 million upfront cost equals the entire annual government budget

- Benefits arrive slowly over 25 years. Costs arrive immediately.

- Politicians get elected every 4 years, not every 25 years

- Buying bottled water distributes the pain so thinly that nobody riots

This is why poor regions stay poor. The math says build the plant. The incentives say buy the bottles. Incentives win every time. It's like knowing you should go to the gym but Netflix is right there.

How to Fix This

International development loans specifically for infrastructure. Low interest, long payback period. The plant pays for itself, just not fast enough for local budgets. Or you could just keep buying bottled water at 40x the price. Both options are available. One is stupid, but both are available.

Comments