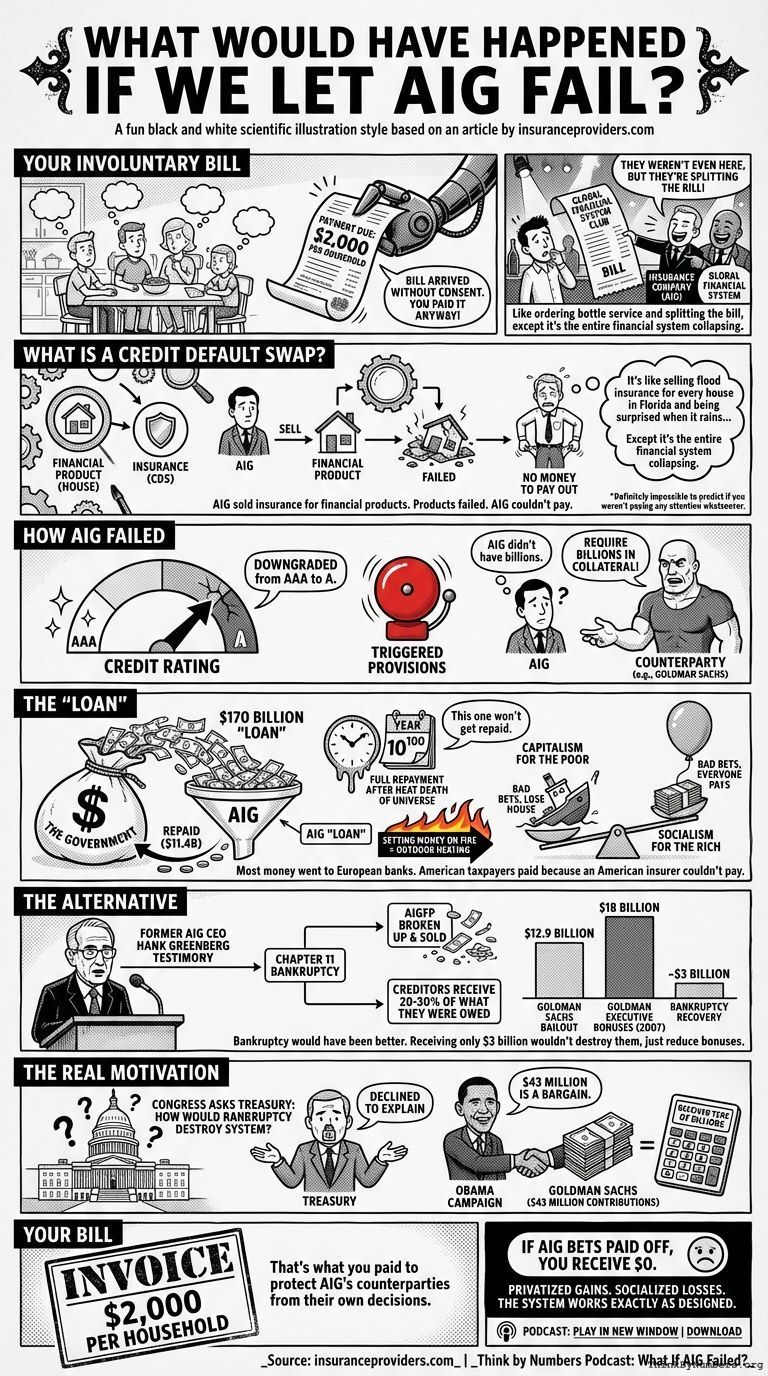

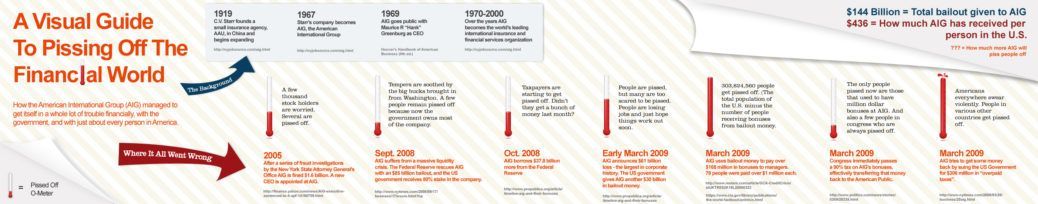

The average American household paid $2,000 to bail out AIG. Your bill arrived without your consent. You paid it anyway.

It's like when someone orders bottle service at the club and then splits the bill evenly, except the someone is an insurance company and the club is the global financial system and you weren't even at the club.

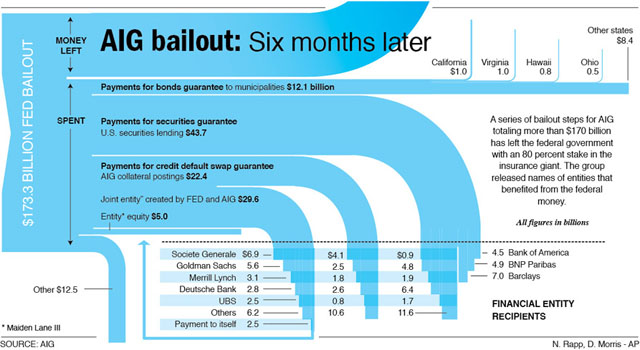

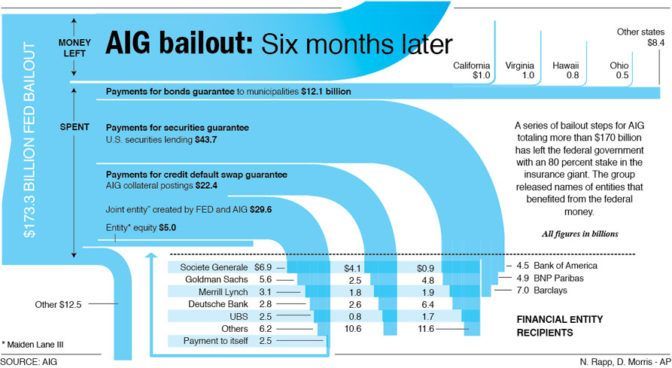

Source: nicolasrapp.com

What Is A Credit Default Swap?

Image by Scott Pollack

A credit default swap is insurance for financial products. AIG sold this insurance. Then the products failed. Then AIG didn't have the money to pay out.

This is what insurance companies call "a problem." It's also what normal people call "not having insurance," but on Wall Street they use fancier words.

Think of it like selling flood insurance for every house in Florida and then being surprised when it rains. Except instead of rain it's the entire financial system collapsing, which was definitely impossible to predict if you weren't paying any attention whatsoever.

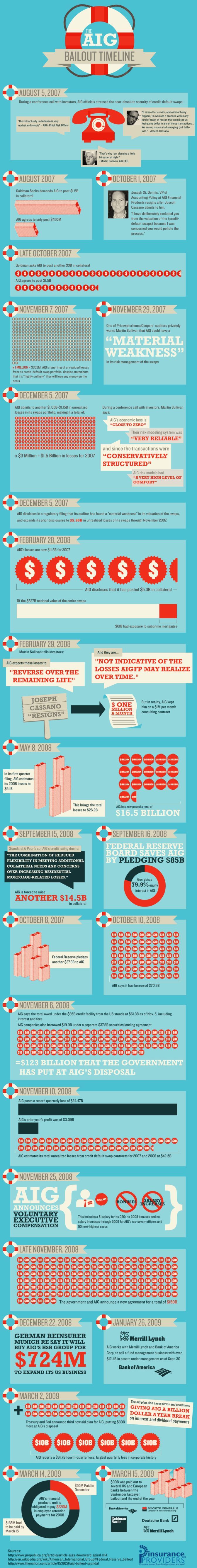

How AIG Failed

AIG got downgraded from AAA to A credit rating. This triggered provisions requiring AIG to provide billions in collateral to counterparties like Goldman Sachs.

AIG didn't have billions in collateral.

The "Loan"

The government loaned AIG $170 billion. This was called a loan. Loans typically get repaid. This one won't.

As of 2011, $11.4 billion has been repaid. At this rate, full repayment will occur sometime after the heat death of the universe.

The word "loan" is doing a lot of heavy lifting here. It's technically a loan in the same way that setting money on fire is technically "outdoor heating."

Most of the money went to European banks. American taxpayers paid European banks because an American insurance company sold insurance it couldn't pay out. Capitalism for the poor, socialism for the rich.

It's a beautiful system. When rich people make bad bets, everyone pays. When poor people make bad bets, they lose their house. This is called "moral hazard," which is Latin for "we can do whatever we want."

The Alternative

Former AIG CEO Hank Greenberg testified to Congress that bankruptcy would have been better for taxpayers.

In Chapter 11 bankruptcy, AIGFP would be broken up and sold. Creditors would receive 20-30% of what they were owed.

Goldman Sachs received $12.9 billion from the bailout. They spent $18 billion on executive bonuses in 2007. So receiving only $3 billion from bankruptcy would not have destroyed them. It would have merely reduced executive compensation.

The Real Motivation

Congress asked Treasury to explain how AIG's bankruptcy would destroy the financial system.

Treasury declined to provide this explanation.

Goldman Sachs was Obama's number one campaign contributor. Goldman Sachs spent $43 million on political contributions.

They received tens of billions from the AIG bailout.

$43 million is a bargain.

Your Bill

$2,000 per household. That's what you paid to protect AIG's counterparties from the consequences of their decisions.

If AIG's bets had paid off, you would not have received $2,000.

Privatized gains. Socialized losses. The system works exactly as designed.

Source: insuranceproviders.com

Podcast: Play in new window | Download

Comments