Toxic Assets

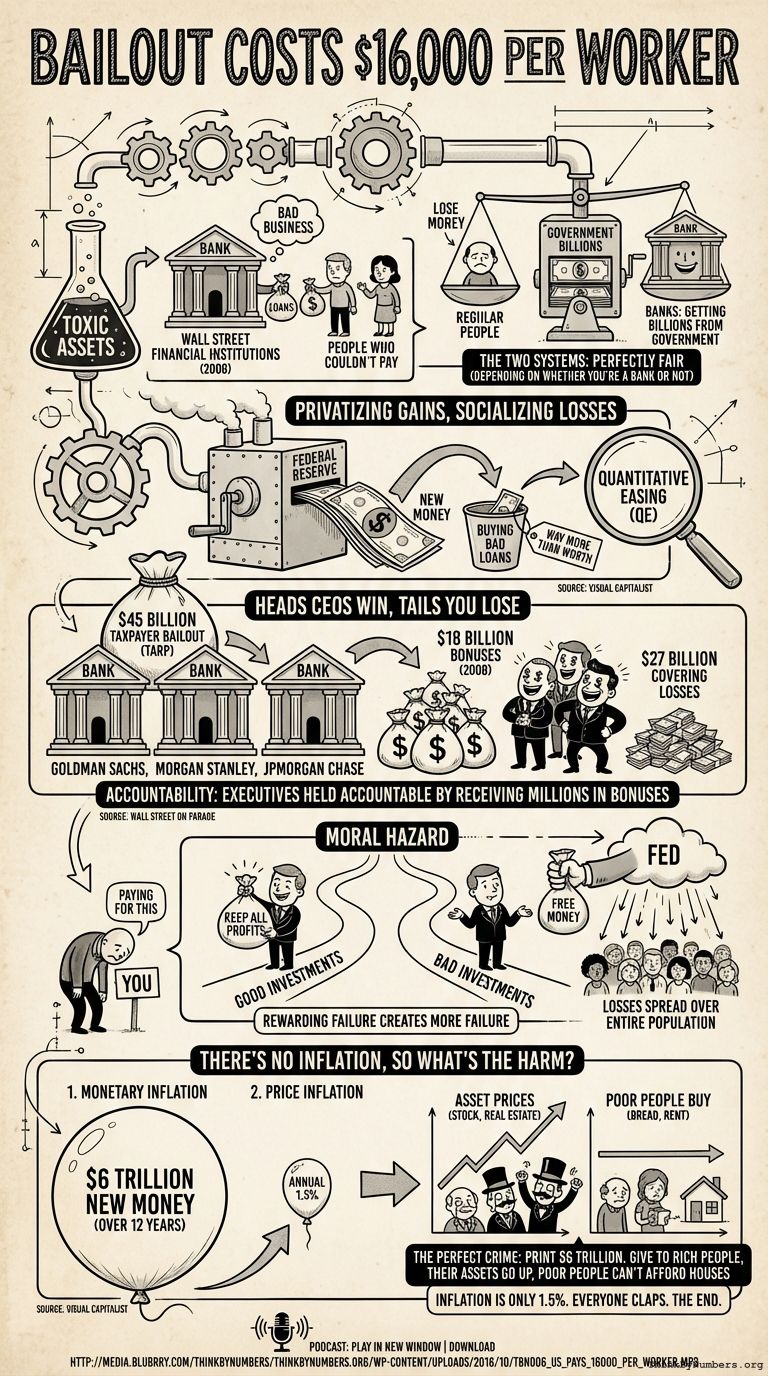

In 2008, Wall Street financial institutions gave loans to people who couldn't pay them back. This is called "bad business." The institutions were going to lose money.

They did not want to lose money.

Losing money is what happens to regular people when they make bad decisions. For banks, there's a different system. It's called "getting billions of dollars from the government." The two systems are very different, but both are perfectly fair depending on whether you're a bank or not.

Privatizing Gains, Socializing Losses

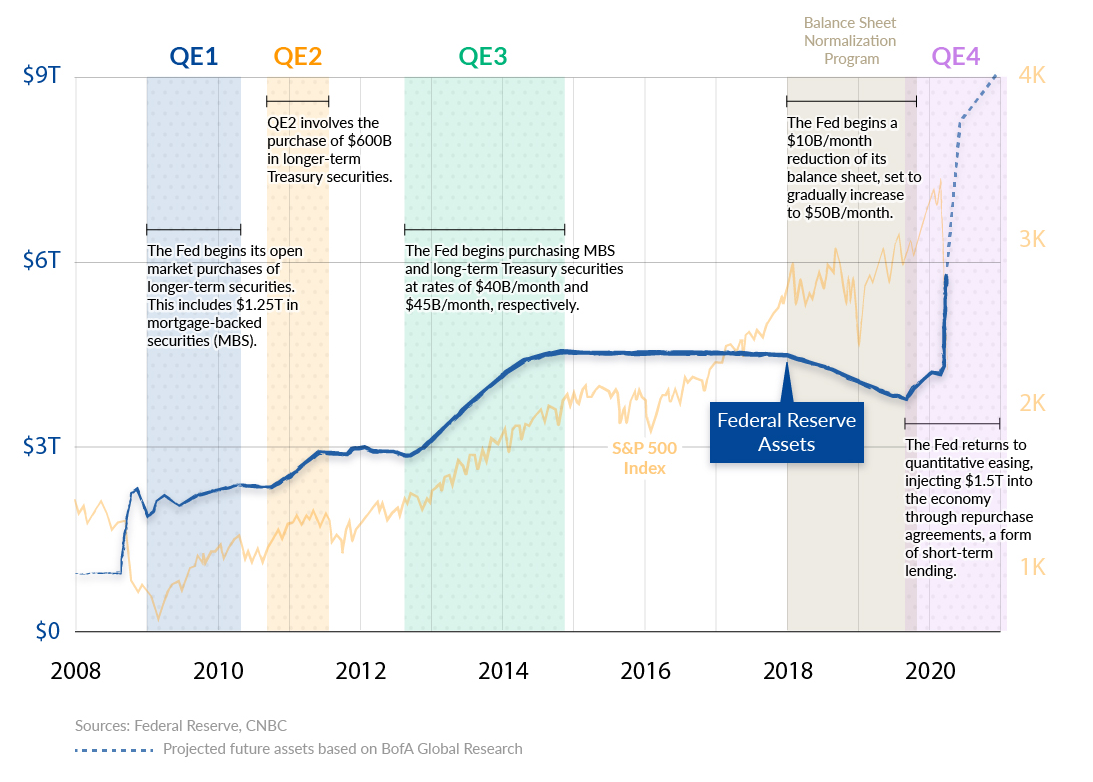

The solution: have the Federal Reserve print new money and buy the bad loans for way more than they were worth. This process is called quantitative easing (QE).

Source: Visual Capitalist

Heads CEOs Win, Tails You Lose

Then the banks used taxpayer money to reward executives for their bad decisions.

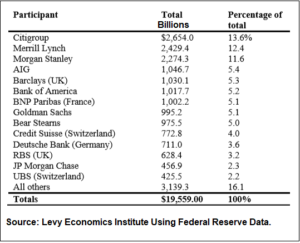

Goldman Sachs, Morgan Stanley, and JPMorgan Chase paid $18 billion in bonuses in 2008. They received $45 billion in taxpayer bailout funds through TARP.

They turned $45 billion of your money into $18 billion of executive bonuses. The remaining $27 billion covered the losses from the bad bets they made.

This is called "accountability." The executives were held accountable by receiving millions of dollars in bonuses. It's a tough lesson, but someone had to learn it. That someone was you, and the lesson was "you're paying for this."

Source: Wall Street on Parade

Moral Hazard

The moral of the story for bankers:

When you make good investments, you keep all the profits.

When you make bad investments, the Fed gives you free money and losses get spread over the entire population.

This is called "moral hazard." It means rewarding failure creates more failure.

There's No Inflation, So What's the Harm?

There are two types of inflation:

- Monetary Inflation - increase in total money supply

- Price Inflation - increase in cost of goods and services

The Fed created $6 trillion in new money over 12 years. That's monetary inflation.

Source: Visual Capitalist

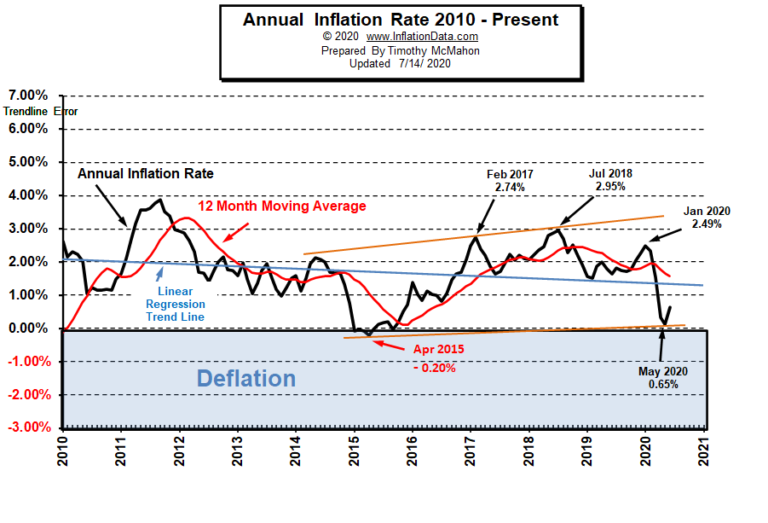

Annual price inflation has only been about 1.5% over the period. So where did the money go?

It went to asset prices. Stock prices. Real estate prices. The things rich people own went up. The things poor people buy stayed relatively flat.

This is how you transfer $6 trillion from everyone to the already wealthy without most people noticing.

It's the perfect crime. You print $6 trillion, give it to rich people, their assets go up in value, and poor people can't afford houses anymore. Then you say "inflation is only 1.5%" because bread prices didn't change. Everyone claps. The end.

Podcast: Play in new window | Download

Comments