US Financial Crisis: Who Killed the Economy?

The cause of the US financial crisis is simple. It’s debt. This is a very simple and graphical evidence-based explanation of what caused the collapse.

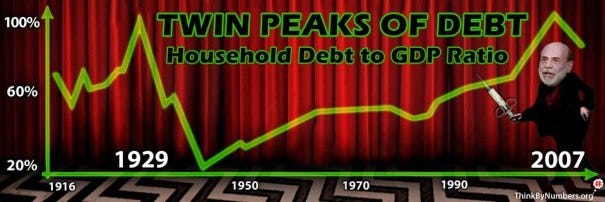

The massive increase in the level of consumer debt before the recent financial crisis bears a striking resemblance to another period in economic history. That other period of unprecedented borrowing occurred just before 1929. Twin Peaks didn’t make it very clear who killed Laura Palmer, but they make it pretty obvious who killed the US economy. The murderer is debt.

The Household Debt to GDP Ratio reached 100% in 2007. That means the average family owed as much on their mortgages, auto loans, and credit cards as they earn in a year. For most of the 20th century, this ratio’s been under 50%. The last time it reached 100% was 1929. Note the twin peaks in the graph.

In both crashes, the primary reason for the increase in debt is the Federal Reserve’s artificial lowering of interest rates. Initially, the lower rates cause people to borrow more to buy more. This behavior serves as a signal to businesses that they should hire more people and expand their production capacity by building more factories and stuff. This leads to short-term economic growth known as the “Boom”.

This Boom period is analogous to the first few weeks of heroin addiction. We’ve all been there. Ben Bernanke hooks you up with some killer junk for the first time. You slide in the needle and pretty soon you’re a quivering mound of oozing pleasure.

Those were some crazy times. Anyway, the Fed’s artificially low interest rates lead to over-borrowing. Eventually, people borrow so much that they can’t take on any more debt so all this buying suddenly stops. Additionally, many people declare bankruptcy when they find they can’t make their payments. According to the graph, this “Bust” period typically initiates when the average household debt to GDP ratio reaches 100%.

When the buying slows down, businesses don’t need so many employees anymore. This leads to layoffs and more bankruptcies. All this new unemployment leads to even lower consumer spending. Lower consumer spending leads to even more layoffs and bankruptcies. Hence, the cycle just feeds on itself.

This suggests that our current crisis is about something much simpler than credit default swaps, derivatives, or toxic assets. It’s all about borrowing more than we can pay back. This is the view of the Austrian economists who accurately predicted the impending disaster. If the government would just let the market set the interest rate you wouldn’t have this unsustainable accumulation of debt and the inevitable resulting crash.

The only problem with that solution is that it makes sense. Hence, it’s not a feasible public policy option. Naturally, the government’s solution was to do even more of what caused the problem in the first place.

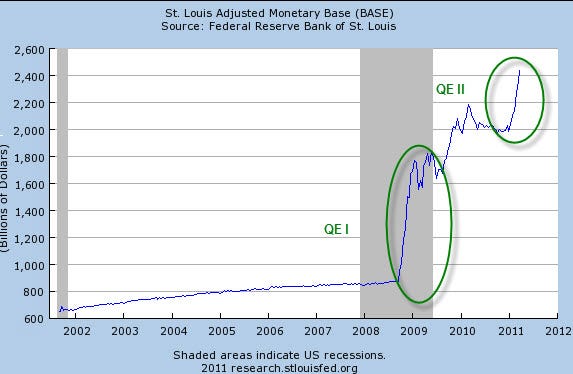

President Obama reappointed Ben Bernanke, the person who’s policies helped create the initial bubble. The Federal Reserve created trillions of more dollars in new loans to stimulate even more borrowing and debt.

Graph Source: http://research.stlouisfed.org

Why would the government behave so irrationally? The reason is that the majority of people with enough expertise and money to influence the system profit from the status quo. Financial institutions like Goldman-Sachs make trillions of dollars in interest by loaning the money the Fed creates.

It works like this:

During the financial crisis, the Fed routinely made billions of dollars in “emergency” loans to big banks at near-zero interest. Many of the banks then turned around and used the money to buy Treasury bonds at higher interest rates — essentially loaning the money back to the government at an inflated rate.”People talk about how these were loans that were paid back,” says a congressional aide who has studied the transactions. “But when the state is lending money at zero percent and the banks are turning around and lending that money back to the state at three percent, how is that different from just handing rich people money?”

To make even more money they loan it to consumers at an even higher rate in the form of mortgages, credit card loans or other forms of lending.

That is why the country’s wealth is continuously being transferred to the relatively non-productive financial sector. The purpose of the banks is basically to facilitate the loaning of money from savers to borrowers and collect interest from the borrower. Most of this amounts to a financial executive sitting at the top of a skyscraper moving numbers from one account to another with a computer. Yet for this simple task, many of these financial executives are paid hundreds of times more than the construction worker who built the skyscraper gets paid.

Here’s a link to an excellent easy-to-understand radio program on the causes of the collapse:

http://www.thisamericanlife.org/Radio_Episode.aspx?sched=1285

Please share your thoughts in the comments section!