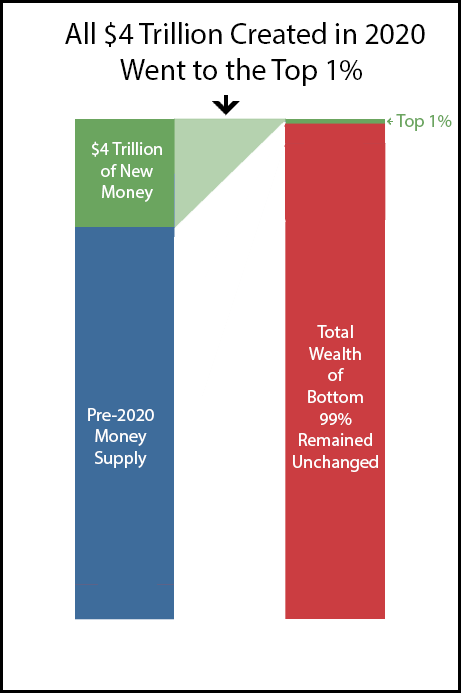

The $4 trillion of new money created by the Federal Reserve as part of the 2020 stimulus program has gone entirely to the top 1% wealthiest people in the world.

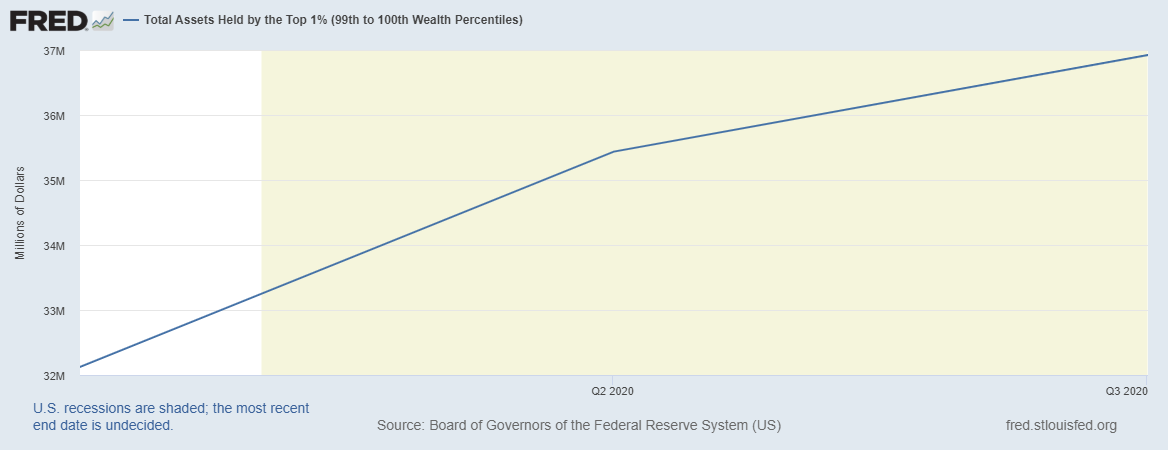

Here’s a chart of the Total Assets Held by the Top 1% in 2020.

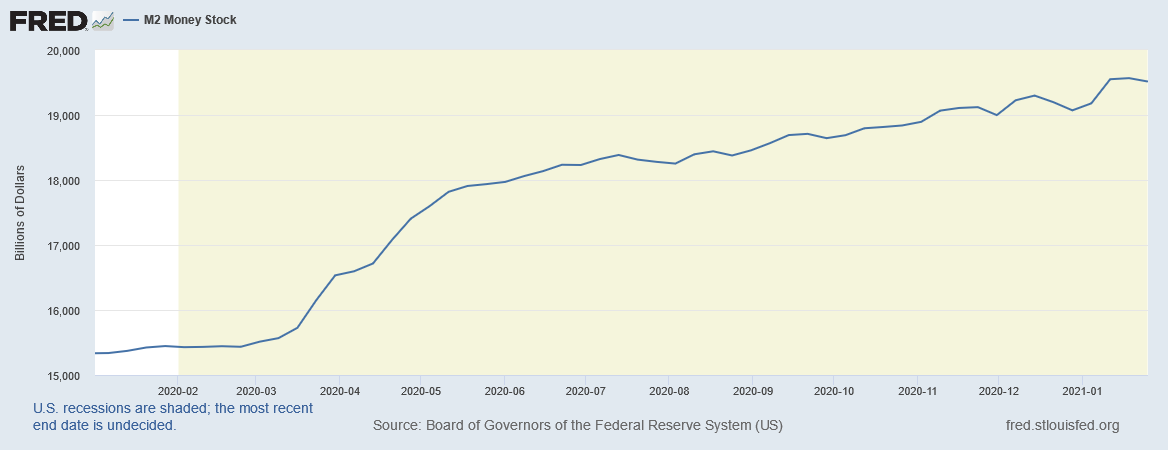

Below illustrates the idential increase in the M2 money supply.

The Fed could distribute all new money equally in the form of stimulus payments or a universal basic income (UBI). However, instead, they effectively pump all new money entirely into Wall St. This is done through the purchase of bonds and securities. They also give it to financial institutions at near 0% interest. Then, financial institutions can loan it to poor people with credit cards and keep the 20% interest.

Stolen Productivity Gains

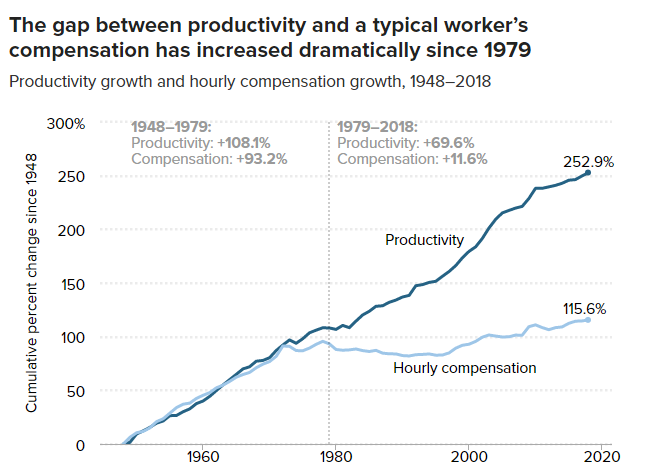

Productivity gains allow the government to do this without increasing the consumer price inflation too much. In the first half of the 20th century, the financial benefits of technological innovation and productivity gains were generally evenly enjoyed by society.

Infinite Money

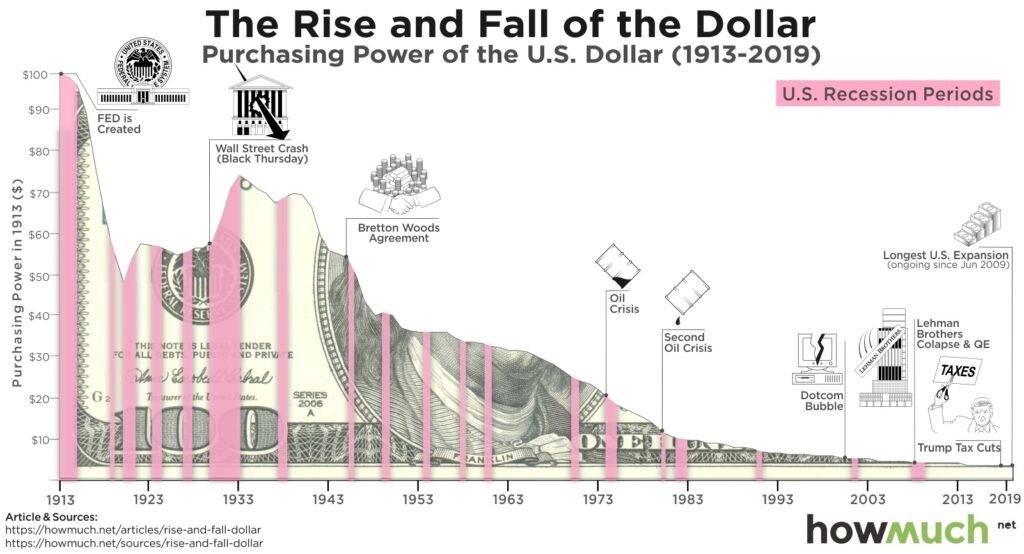

However, in the 1970s, Nixon completely eliminated the gold standard. This removed the restriction on the Fed’s ability to create new money. Before that, they could only create enough money that would allow someone to buy an ounce of gold for $35 from the US treasury’s “gold window” Now the Fed could print as much new money as they want. This new money was used to fund unpopular programs like the Vietnam War and bank bailouts. That way you wouldn’t have to persuade the public to pay for them through taxes.

The inevitable result of creating new money is the devaluation of the currency.

When a currency is devalued, the value doesn’t just disappear from the universe. The value is transferred from the general population to those who receive the new money. The ones who receive the new money are the top 1% who happen to own the most securities.

A Big Inequality Factory

The purchasing power benefits that would have been seen by the general population from productivity gains are just canceled out by the devaluation of their paychecks. So the Federal Reserve is basically a big factory that only manufactures inequality.

A Bipartisan Alternative

Having the Fed distribute new money equally through a Universal Basic Income would solve this problem. It seems like a great bipartisan issue, too. Polls show everyone loves stimulus checks. Socialists and democrats should like it because it reduces inequality. Libertarians and classical republicans should like it because it shifts societal resource allocation decisions from central planners in Washington to individual choices in the free market.

What do you think?

Please tell me where I’m wrong or how we could get this implemented in the comments!