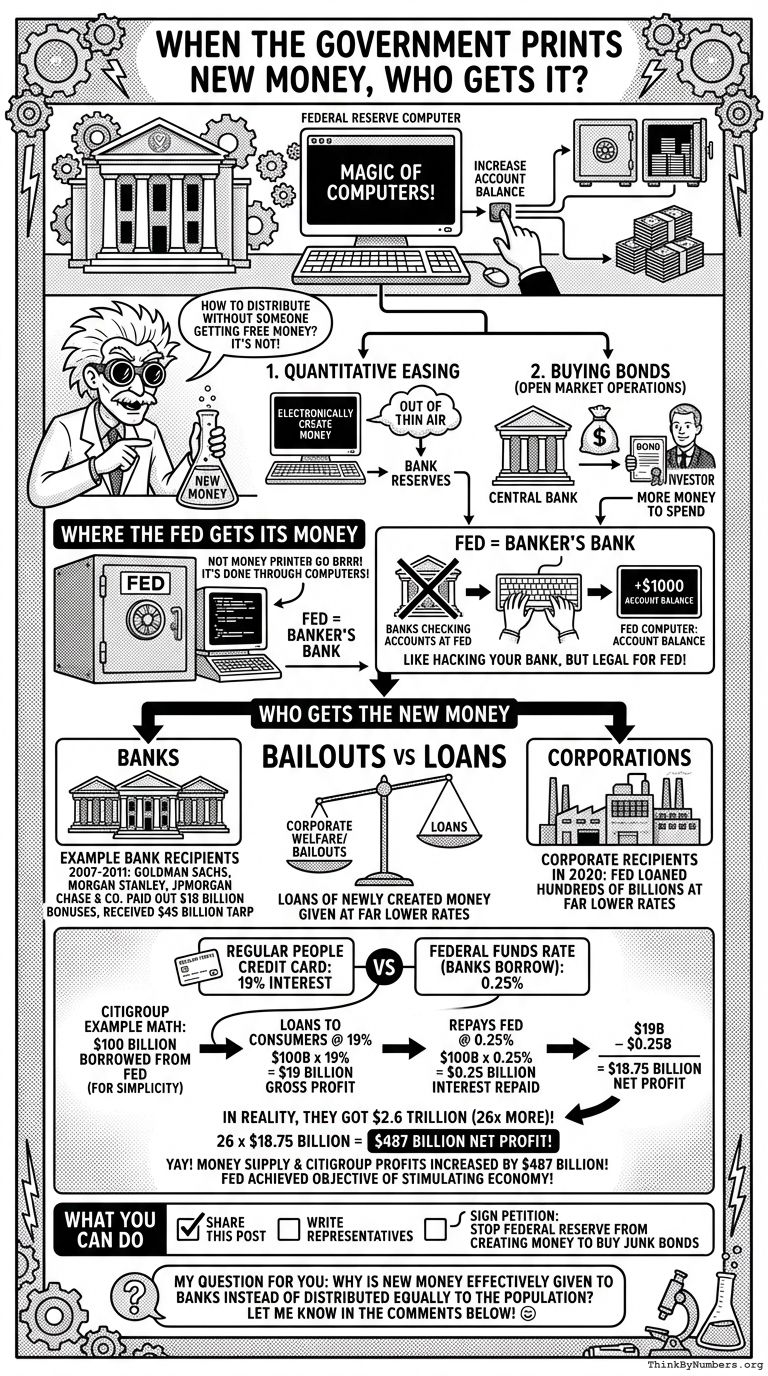

When the government creates new money, how is it possible to distribute it without someone just getting a bunch of free money for nothing? The answer is that it’s not.

The Federal Reserve is responsible for deciding how much money there currently is in the economy. In recent years, there are 2 primary ways they do this.

Ways to increase the money supply

- Quantitative easing. The Central Bank can also electronically create money. Under a policy of quantitative easing, they decide to increase their bank reserves ‘effectively create money out of thin air’.

- Buying bonds. The Central Bank pays investors holding bonds. If the Central Bank buys Government securities (or corporate bonds) people who were holding the bonds have more money to spend. This method is also referred to as Open Market Operations.

Where the Fed Gets Its Money

How do they actually make the money, you ask? They don’t even have to make money printer go brrr. It’s all done through the magic of computers!

The Fed is a banker’s bank. Banks have checking accounts at the Fed like you or I might have a checking account at Chase or Bank of America. If you hacked into your bank’s computer system and increased your account balance by $1000, you’d suddenly be $1000 richer. The Federal Reserve can do the same thing with the accounts of its customers (other banks).

Who Gets the New Money

- Banks

- Corporations

Example Bank Recipients

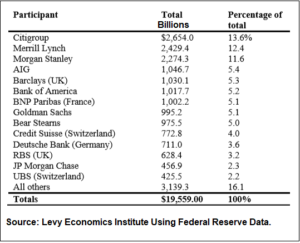

Largest Recipients of Federal Reserve-Bailout Funds 2007 to 2011

Goldman Sachs Group Inc., Morgan Stanley, and JPMorgan Chase & Co. paid out a total of $18 billion in bonuses in 2008 while receiving a combined total of $45 billion in taxpayer dollars through the Troubled Asset Relief Program (TARP).

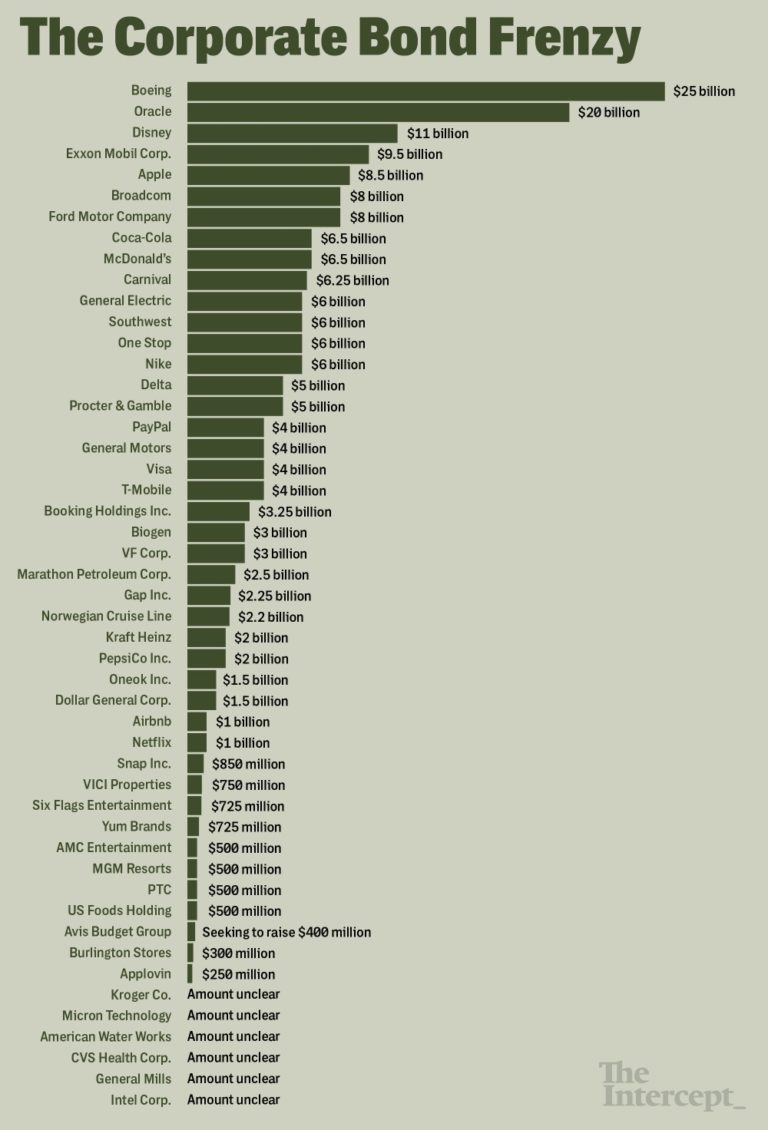

Corporate Recipients in 2020

In 2020, the Fed loaned hundreds of billions at interest rates far lower than they would have been able to borrow at otherwise.

Source: https://theintercept.com/2020/05/27/federal-reserve-corporate-debt-coronavirus/

Bailouts vs Loans

Although there are plenty of cases of straight-up corporate welfare and bailouts, the majority of this new money is given out in the form of loans. Loans seem reasonable enough. However, these loans of newly created money are given to banks and corporations at rates far lower than can be obtained by regular people in the free market.

The average credit card interest rate charged to regular people is 19%. The federal funds rate that banks can borrow at is 0.25%. So let’s say Citigroup borrows $100 billion from the Fed. (They actually got $2.6 trillion during the first bailouts, but let’s use $100 billion to keep the math simple.)

Citigroup loans this $100 billion to consumers with credit cards at 19% interest and makes $19 billion in total gross profit on interest.

$100 billion x 19% = $19 billion gross profit

Then Citigroup repays the Fed 0.25% interest.

$100 billion x 0.25% = $0.25 billion interest repaid to Fed

$19 billion gross profit – $0.25 billion costs of borrowing = $18.75 billion net profit

As I said, in reality, they actually got $2.6 trillion or 26 times more than that.

26 x $18.75 billion = $487 billion

Yay! The money supply and Citigroup’s profits have been increased by $487 billion! Now the Fed has achieved its objective of stimulating and stabilizing the economy!

What You Can Do

If you think that new money should be distributed more fairly and overthrowing the government isn’t your style, you could:

- Share this post

- Write your representatives

- Sign this petition: Stop the Federal Reserve From Creating Money to Buy Junk Bonds

My Question for You

Why is new money effectively given to banks instead of distributed equally to the population? Let me know in the comments below! 😀

Comments