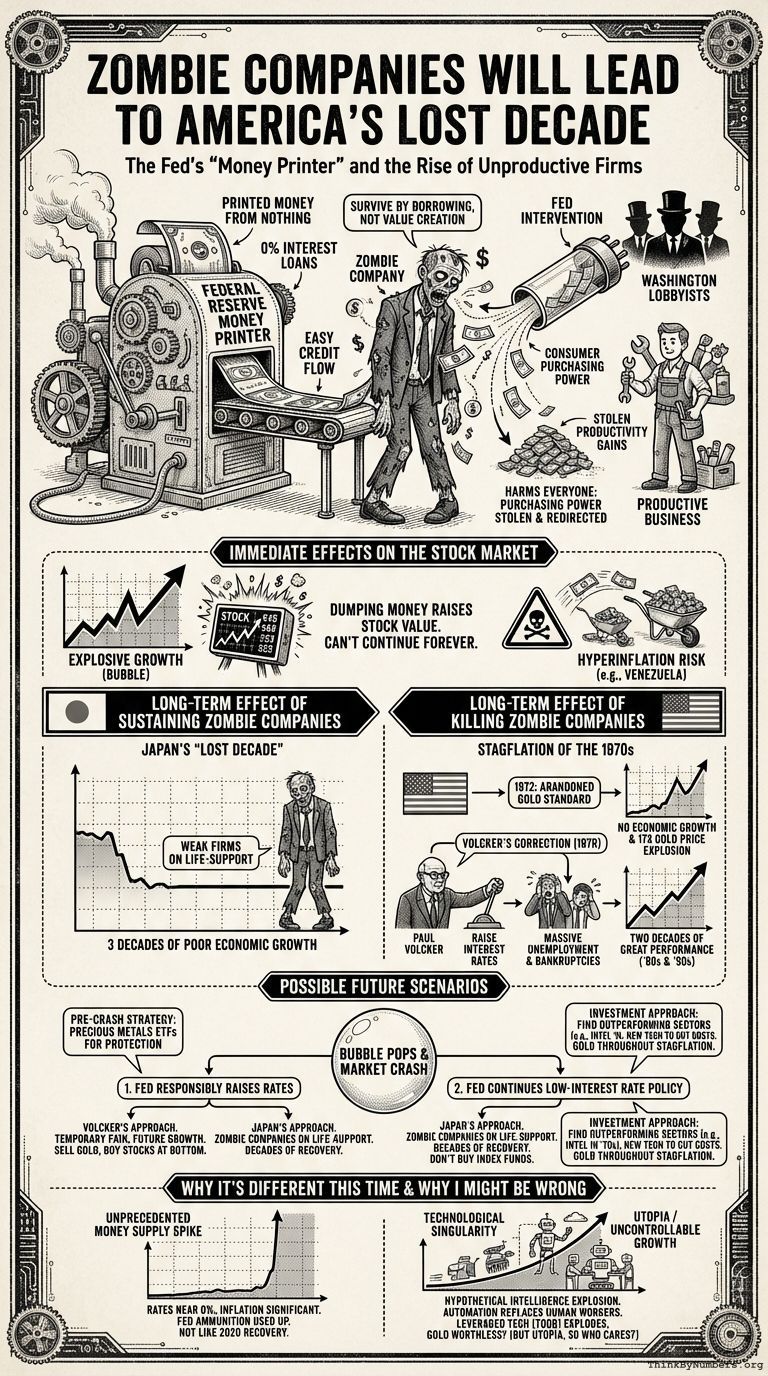

The Fed is printing money and giving it to Zombie Companies. These are firms that don't survive by producing value for customers. They survive by borrowing at near 0% interest from the Federal Reserve, which creates this money from nothing.

How This Harms Everyone

When the Fed creates new money, it has the same effect as criminal counterfeiters. Instead of consumers supporting businesses that provide valuable goods and services, the Fed steals that purchasing power and gives it directly to corporations without them having to produce value.

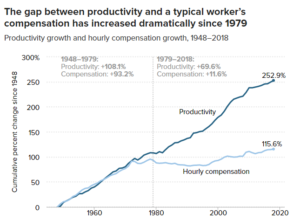

Stolen Productivity Gains

In the first half of the 20th century, technological innovation and productivity gains benefited society. Since the end of the gold standard, all benefits now funnel to those with the most effective Washington lobbyists.

Immediate Effects on the Stock Market

Dumping money into corporations raises their stock value. You can see this in the recent explosive growth in the US stock market. However, it can't continue forever. That would lead to catastrophic hyperinflation, as seen recently in Venezuela and throughout history.

Long-Term Effect of Sustaining Zombie Companies

See Japan's "Lost Decade." Japanese banks supported weak or failing firms. The result: three decades of poor economic growth.

Long-Term Effect of Killing Zombie Companies

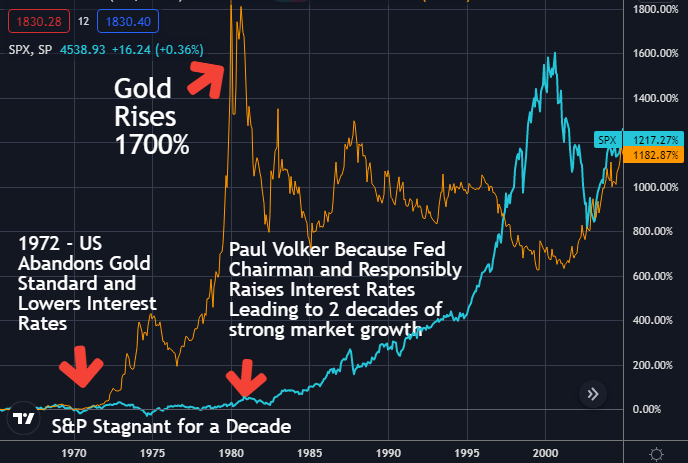

See the Stagflation of the 1970s. The US abandoned the Gold Standard in 1972, allowing the Federal Reserve to print unlimited money. What followed: almost no economic growth for a decade and a 17X explosion in gold prices.

Then Jimmy Carter appointed Paul Volcker as Fed chairman. Volcker raised interest rates. This caused massive unemployment as zombie companies went bankrupt or restructured. The long-term result: two decades of great stock market performance through the '80s and '90s.

Possible Future Scenarios

Based on all past periods of massive monetary supply inflation, the US will likely reach a point where the bubble pops and the stock market crashes.

Pre-Crash Strategy

Ideally, you'd have insider information from the Federal Reserve and Wall Street to predict the crash timing. However, for the rest of us, precious metals ETFs offer protection from these losses.

Post-Crash Scenarios

1. Fed Responsibly Raises Interest Rates

If the Federal Reserve behaves responsibly, they'll raise interest rates and force zombie companies to go bankrupt or restructure. This was Paul Volcker's approach in 1979.

Higher interest rates will temporarily increase unemployment and crash the stock market. However, after this correction, sell your gold ETFs and buy stocks at the bottom. Enjoy significant future growth.

2. Fed Continues Low-Interest Rate Policy

This was Japan's approach in the '90s. Zombie companies were kept on life-support. The result: 3 decades to recover.

Given that nobody has the political will to cause short-term pain through higher interest rates, this seems most likely.

The best investment approach is more complicated. Don't buy general index funds like the Dow or S&P. Over the 1970s, inflation climbed 103% compared to only 16% for the S&P 500.

However, you may find good companies or sectors that outperform the overall market. Intel grew 1,230% during the '70s despite stagflation. New technologies offer companies ways to cut costs they must adopt to survive economically desperate times.

You would have done better sticking with gold throughout the '70s. 1,700% return if you sold as soon as Paul Volcker started raising interest rates.

Why It's Different This Time

A coming market crash (if it happens) won't be like recent corrections that turn around in a few months. In the past, the Fed addressed them by lowering interest rates and increasing the money supply. This time, rates are already near 0% and we have significant inflation.

The money supply spike has been unprecedented.

The Fed has used up most ammunition normally available to deal with financial crises like 2008.

This also means recovery will be nothing like 2020's amazing recovery after the coronavirus crash. That crash was a once-in-a-lifetime buying opportunity. Mass hysteria and uncertainty drove stock prices irrationally low. Then a once-in-a-lifetime money supply explosion pumped stock prices far higher than they started.

Why I Might Be Wrong

The technological singularity—or simply the singularity—is a hypothetical point in time at which technological growth becomes uncontrollable and irreversible, resulting in unforeseeable changes to human civilization. According to the most popular version of the singularity hypothesis, called intelligence explosion, an upgradable intelligent agent will eventually enter a "runaway reaction" of self-improvement cycles, each new and more intelligent generation appearing more and more rapidly, causing an "explosion" in intelligence and resulting in a powerful superintelligence that qualitatively far surpasses all human intelligence.

At some point, there'll be a snowball of technological advancement where everything is automated and all the idiot human workers are replaced by superior automation. Then leveraged technology index funds like TQQQ will explode to infinity. I would feel like an idiot with my relatively worthless gold.

But if that happens, we'll be living in a utopia anyway, so I probably won't worry about it.

Comments