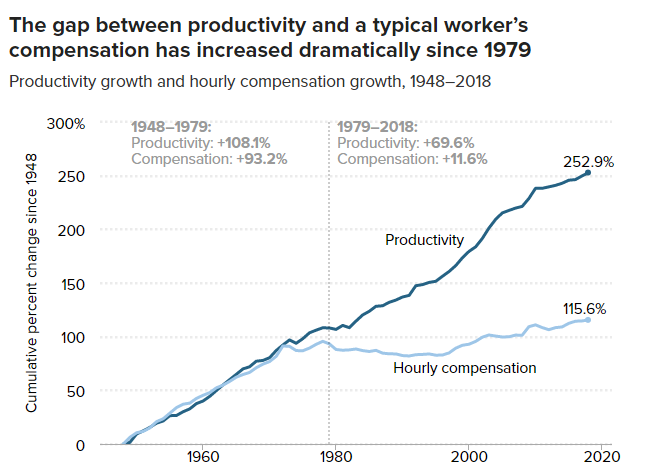

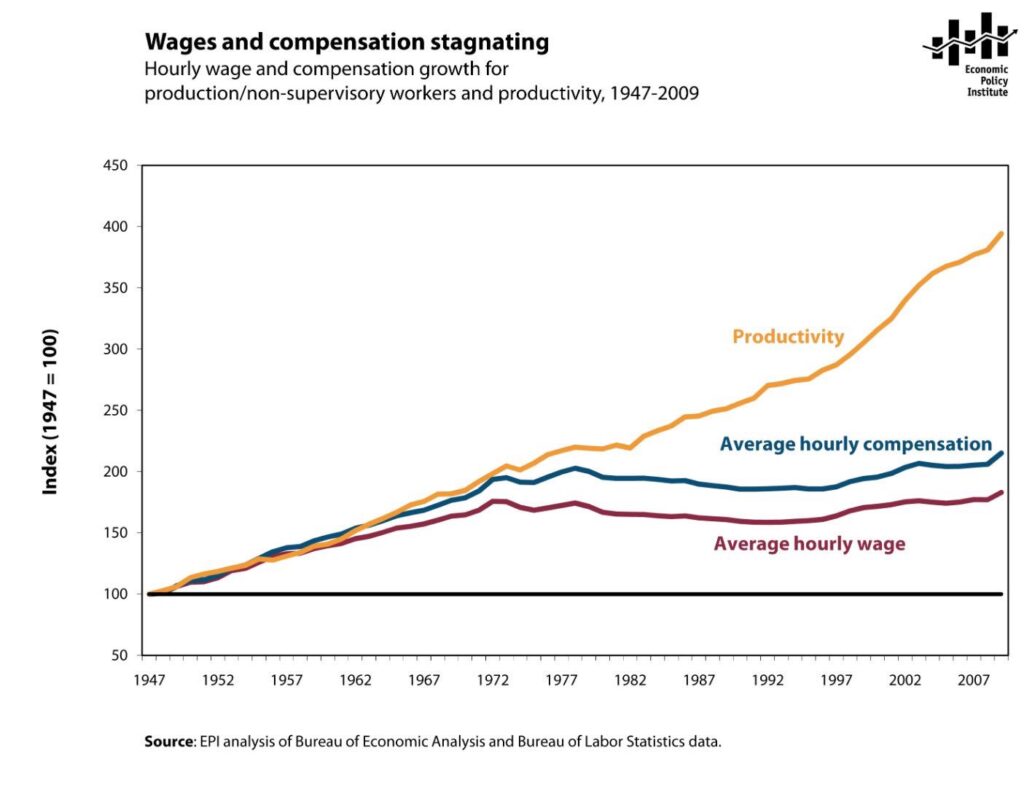

Prior to 1971, productivity growth was very closely tied to wage growth. However, around 1971, there was a stark and sudden decoupling between productivity and wages.

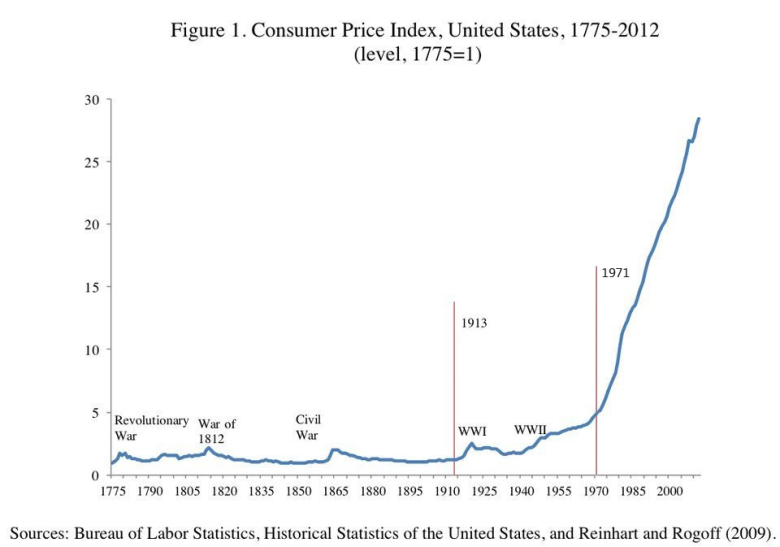

This decoupling perfectly coincides with President Nixon’s abandonment of the Gold Standard. This completely eliminated the limitation on the amount of new money the Fed could print for its friends.

Prior to 1971, the US Treasury had to be able to give you an ounce of gold if you gave it $35. Thus, it couldn’t print more money than it had enough gold to trade for.

It intuitively feels like there has been little downside to all this money printing. However, the cost is the sacrifice of the increase in shared prosperity that productivity growth would have given us.

Increased productivity results from technological and process innovation make it possible for us to produce a lot more stuff with the same amount of resources. Assuming the money supply was kept constant, we could buy a lot more stuff with the same wages.

However, this would-be increased purchasing power is canceled out. The gains are instead concentrated in the hands of Wall Street bankers with direct access to the printing press. The result has been a ton of money-printing and the dollar losing 80% of its value.

The New Pharaohs

Printing new money wouldn’t matter if they distributed it evenly to everyone. However, it initially goes to large financial institutions for almost zero interest. Then they loan it to consumers for much higher interest rates. They’re then able to capture the majority of the new wealth.

Goldman Sachs can borrow $100 billion at near 0% interest. Then they charge 4% interest and make $4 billion for handling billing and keeping track in a spreadsheet. Credit cards can charge like 20%, so that would be $20 billion in free money.

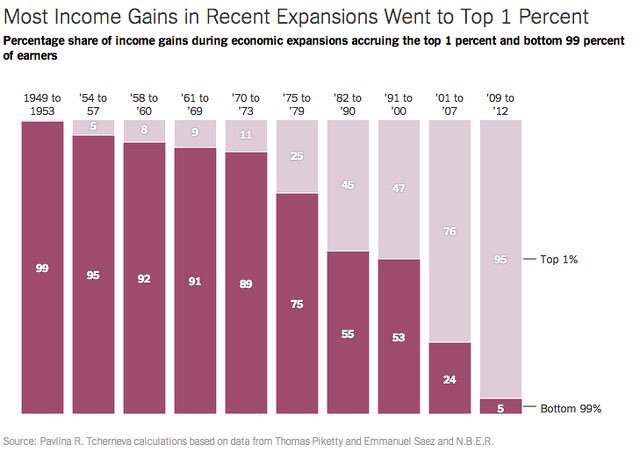

The result of these policies has been a massive increase in wealth inequality and concentration of wealth.

The financial sector effectively consists of modern-day Pharos with regular workers being their slaves. They have a revolving door with the Federal Reserve and US Treasury that’s constantly increasing the money supply which has the same effect as counterfeiters. Like with counterfeiters, the first person who spends the money gets pre-inflation value and as it filters out to regular people it’s worth less and less. Technological productivity gains should be constantly decreasing the cost of living but all the value gets stolen by the government and financial sector.

The World that Might Have Been

The 1971 median household income was $53,286.16 (in today’s dollars). Productivity is 2.3 times higher in 2022 than it was in 1971. If you multiply, $53k by 2.3, the current median household income would be $122k. In reality, the median household income was $67,521 in 2020. This means:

Federal Reserve policies are effectively stealing $54k from the typical family every year.

So a large fraction of the value of everyone’s labor is going to benefit a tiny number of people. We don’t get whipped like Egyptian slaves but at least the Egyptians knew they were slaves.

How The Federal Reserve Steals from the Poor and Gives to the Rich

Zombie Companies Will Lead to America’s Lost Decade

Much of the massive amount of new money the Fed is printing is going into…

Top 1% Received all of the $4 Trillion Printed in 2020

When the government prints new money, who gets it?

Financial Sector Costs Us More than Any Other Sector In Economy

The financial sector receives more of the average paycheck than any other sector of the…

Housing Bubble Wastes $2 Trillion on 14 Million Empty Houses

Image by Ed Hall (halltoons) Empty houses in the US = 14…