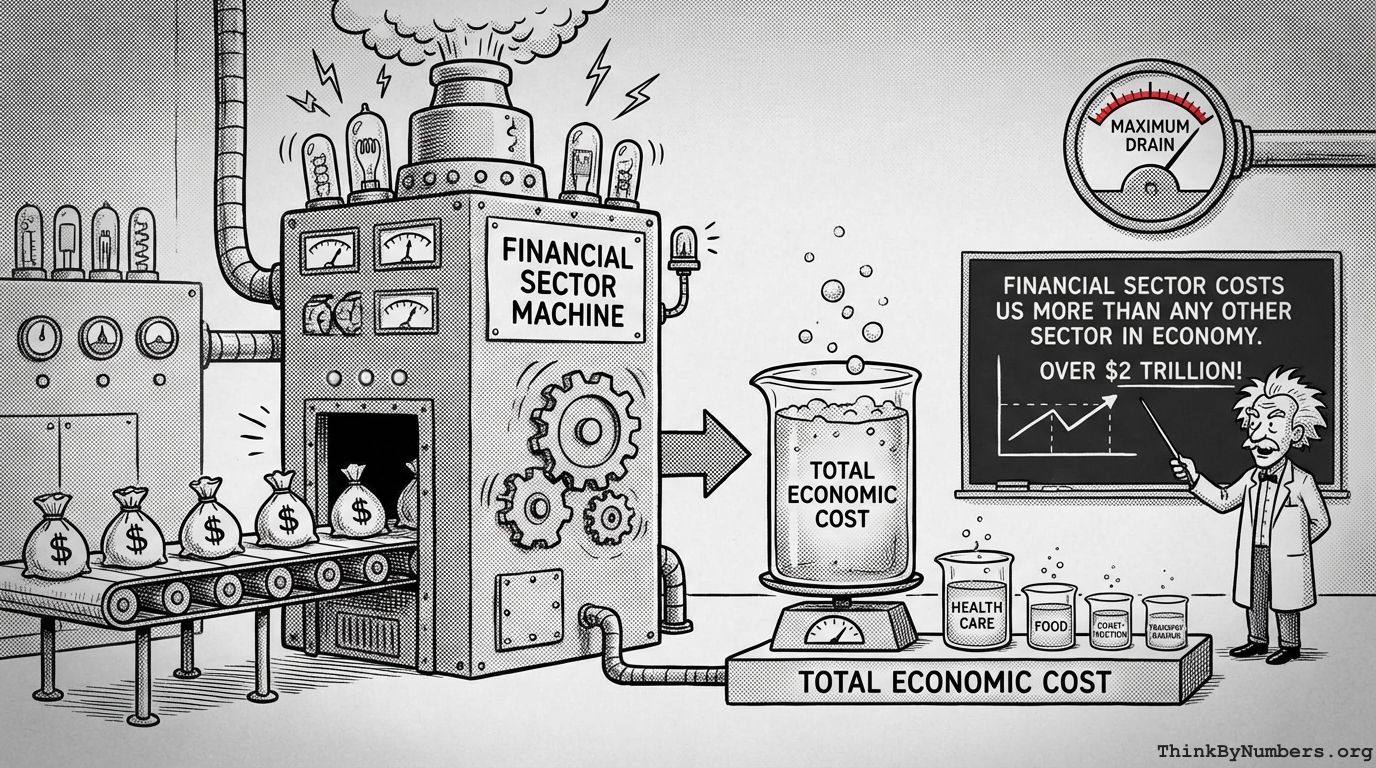

Finance jumped from 4% of GDP (1960s) to 8% (2007), costing $2 trillion annually—more than healthcare, construction, food combined. It's computer money-shuffling.

GDP

4 posts in this category

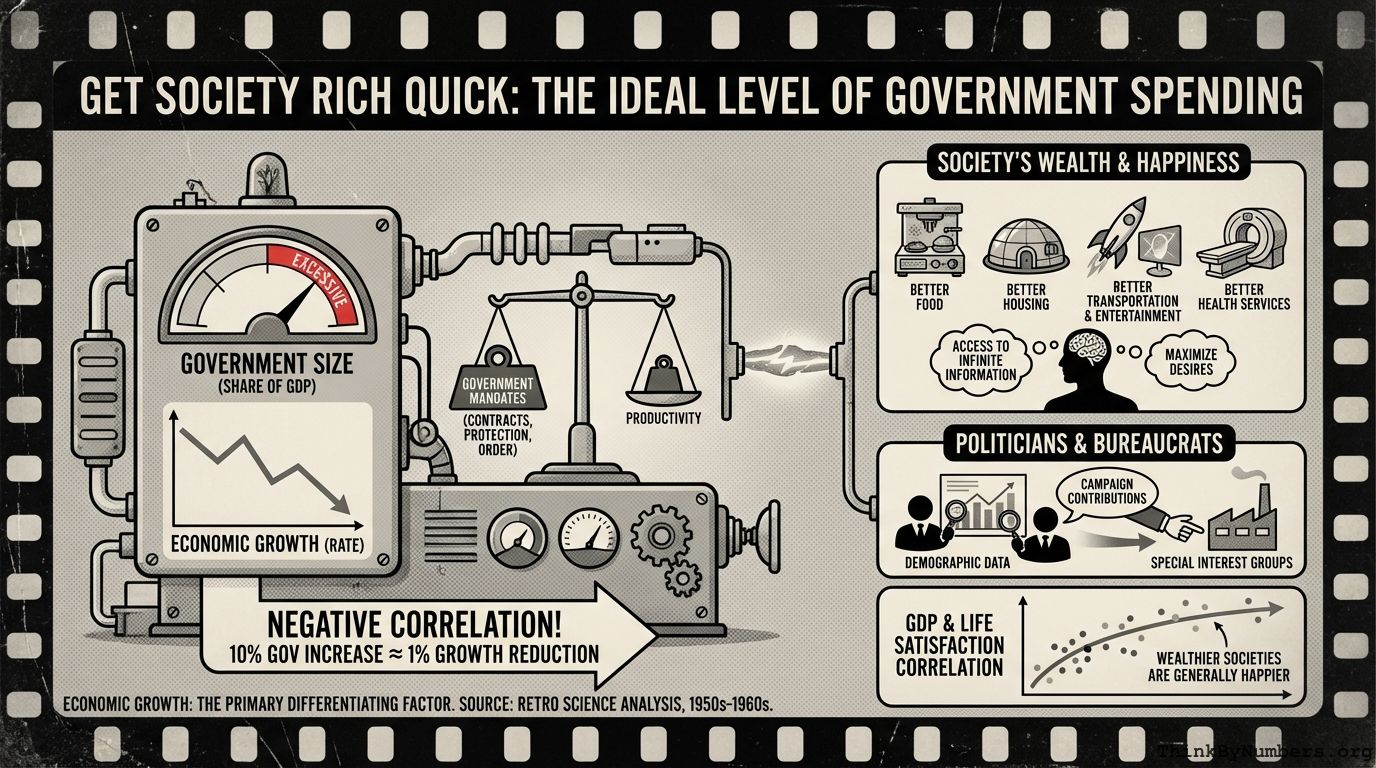

Government spending above 25% of GDP slows economic growth. OECD countries prove it. Every dollar above 25% is basically lighting money on fire and calling it policy.

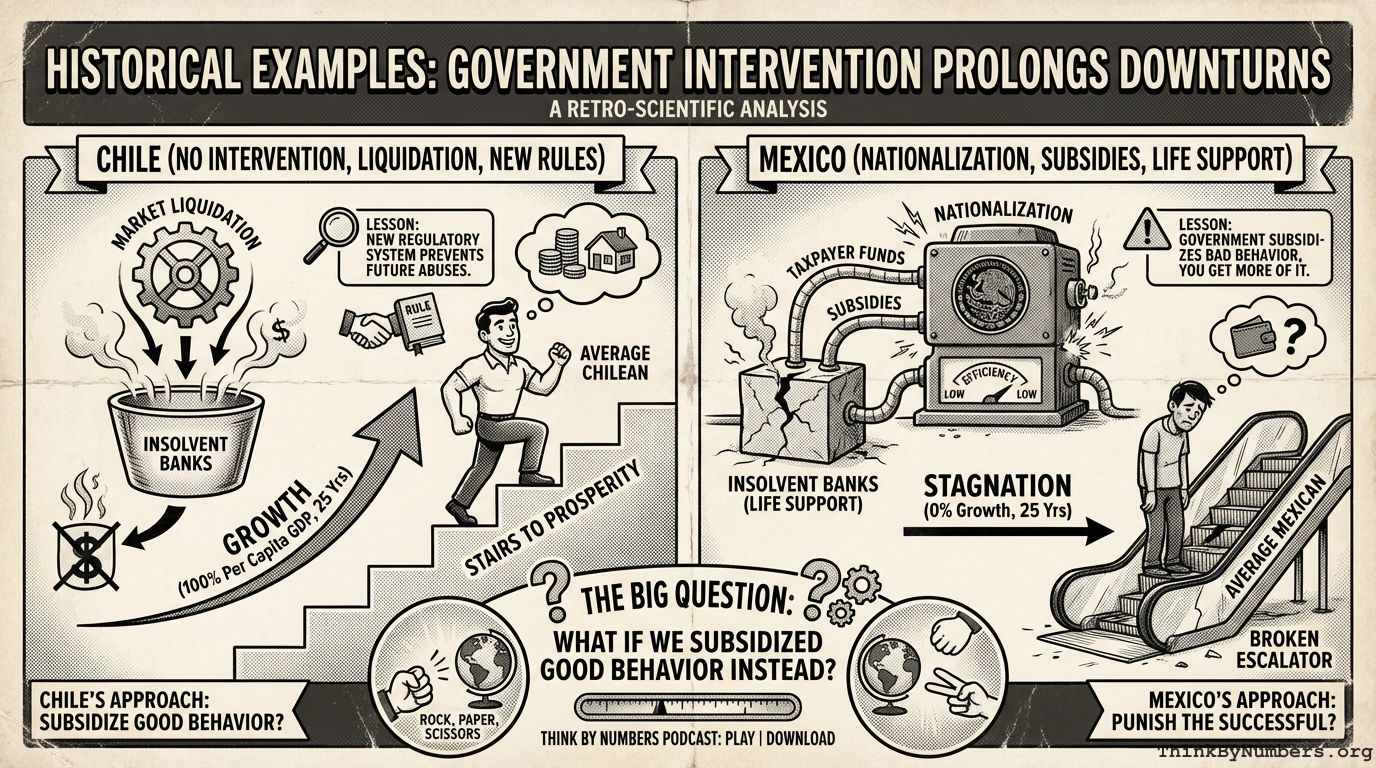

Chile recovered from 1982 crisis in 2.5 years without bailouts. Mexico took 7 years with intervention. Government stimulus is like using a flamethrower to put out a fire.

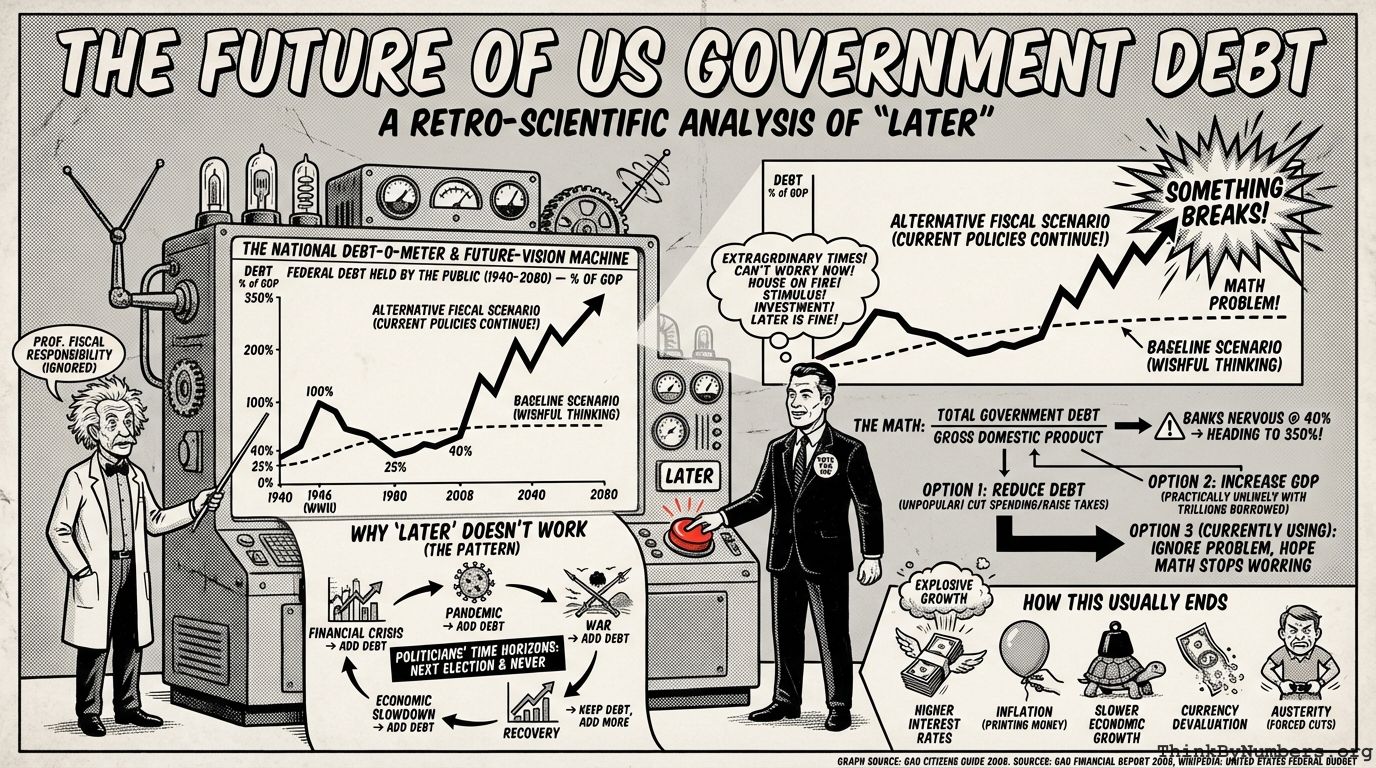

Debt projected to reach 350% of GDP by 2080 if policies continue unchanged. It's not a prediction; it's a math problem with one solution: something breaks.